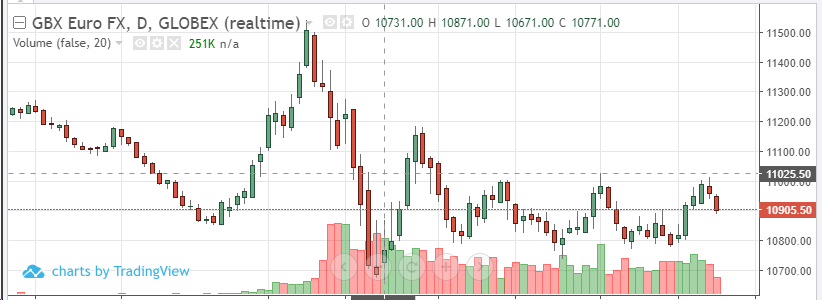

U.S. dollar futures are roughly 40 points higher Friday morning as foreign fiat futures trade in the red. The greenback has moved sideways for two months, fluctuating between 98 and 101 as optimism levels waver. For the bulls to regain control, look for a close above 101. This will likely occur if weakness takes control of the equity markets again next month. The other side of the dollar trade is the euro. Earlier this week, the euro ran into resistance at the 38.2% Fib retracement level for the third time in two months. Once again, the currency sold off from the 1.10 level. The fundamental story supports non-dollar currencies over the intermediate/long-term. Technical cycles point to strength in the euro over the summer months. Look for a close above 1.1028 followed by a run to 50% retracement at 1.1110. Any positive vaccine news is likely dollar bearish. Watch for strength in equities to support foreign currencies as well.