Global equity markets were mixed Wednesday night with Pacific Region stocks softer and some European indices trading higher. Despite increased two-sided volatility in the NASDAQ this week, most equity market measures are at or near new all-time highs in the early Thursday US trade. However, the markets appear to have balanced the overbought technical condition from the November 28th explosion with 24 hours of uncertainty on the charts and that could pave the way for even more gains directly ahead. The bull camp is clearly benefiting from a convergence of positive themes with tax reform progress hopes very high, US scheduled data coming in better than expected and talk this week that the Yellen recovery is broadening. As indicated already, the markets uncertainty over the last 20 hours of trade could have balanced the overdone technical condition enough to set the stage for even more impressive upside work later Thursday. However, the fly in the ointment for the bull camp in the E-mini S&P could be the PCE inflation readings later Thursday morning as the Fed Beige Book Wednesday seemed to rekindle rate hike discussions and that could be an element that is up to the task of derailing the bull market. Support comes at 2625 with 2642 as first resistance.

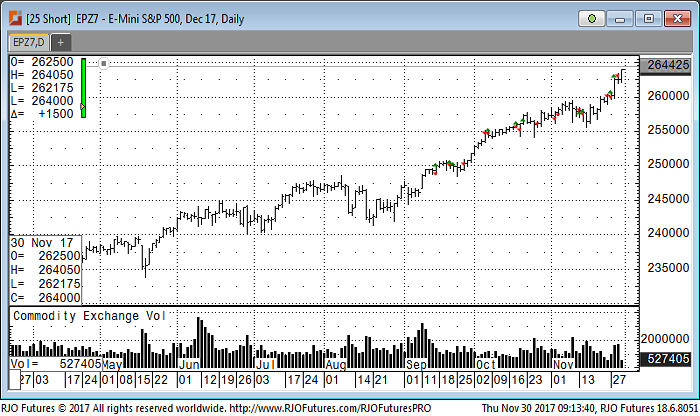

E-mini Dec ’17 Daily Chart