The December E-mini S&P is trading in a narrow range this morning trading, with a high of 2998 and a low of 2681, while overseas markets in Europe finished a tad lower across board. Big market movement is likely in all stock indices later this morning as Fed Powell is talking to the Economic Club of New York at 11:00am. The street will be monitoring closely to see if Powell changes his tone from October stating that the Fed is still on course to hike rates. My belief is the market has priced in a December hike, but the wildcard is unclear going forward as 2019 nears. A good market to watch to get a feel of where the S&P might be going is the yen. As the yen rises, it is normally believed to be a risk on sentiment which is positive for stocks and if the yen falls, it is normally believed to be risk off, which is negative for stocks.

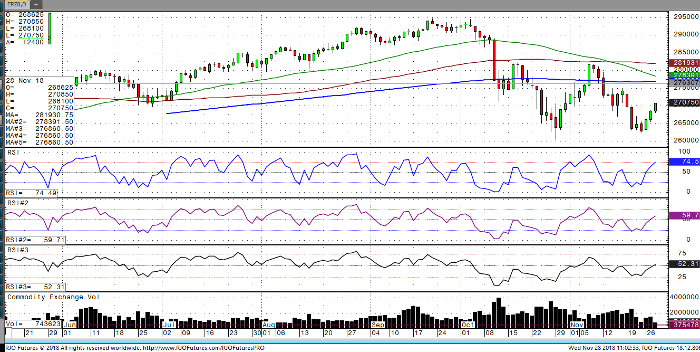

Technicals: The S&P has been making higher highs the last three days but should face stiff resistance near 2697-2710 area. Additionally, the market is still below the 50, 100 and 200 day moving averages.

E-Mini S&P 500 Dec ’18 Daily Chart