The stock market is set to open lower this morning after President Trump said there is no need to rush a trade agreement with China and new tariffs will make the United States stronger.

On May 10th, President Trump tweeted “Talks with China continue in a very congenial manner – there is absolutely no need to rush – as Tariffs are NOW being paid to the United States by China of 25% on 250 Billion Dollars worth of goods & products. These massive payments go directly to the Treasury of the U.S…. Tariffs will bring in FAR MORE wealth to our Country than even a phenomenal deal of the traditional kind. Also, much easier & quicker to do. Our Farmers will do better, faster, and starving nations can now be helped. Waivers on some products will be granted, or go to new source!”.

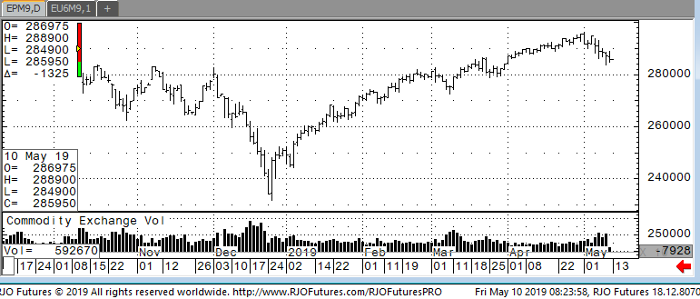

The market continued this week’s sell-off with the S&P 500 losing 2.5% and the Dow dropping more than 650 points. If these losses hold it would mark the worst weekly return of the year. Items to watch today include-New York Fed President John Williams will make remarks at the annual Bronx Bankers Breakfast 10a.m -The Treasury Department will release the April deficit or surplus of the federal budget at 2p.m- Uber’s long-awaited stock offering on the NYSE.

Resistance today is checking in around 289700 and 291500 with support at 284800 and 282000.

E-Mini Jun ’19 Daily Chart