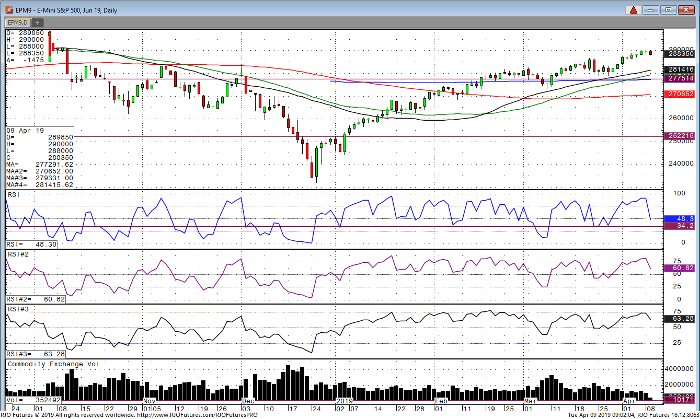

Stocks have continued to climb the wall of worry, ignoring weak economic growth in both the U.S., Europe, and Asia. This week is critical starting tomorrow, with ECB and CPI in the states and FOMC minutes. The S&P 500 got up to 2890 last night but has backed off considerably due to the IMF lowering global growth and Trump saying he is going to put tariffs on Eu for 11 billion of imports. So, as we approach new highs in stocks, we are seeing many headwinds that can put a halt to this rally. As for traders who are contrarians, Barron’s came out with their latest issue “Is the bull unstoppable”. I am certainly not calling for a top, but when you see headlines such as the above, its often the retail investor that is the last to jump in on the long side which some in the industry say is often the end of the bull market. We will have to wait and see.

The best performing index so far has been tech, and it’s acting very heavy this morning. In my opinion, tech has much more on the way of downside than the S&P and Dow. Another important piece of news the comes out on Friday is the start of earning season with big banks reporting. I bring this up because in the last month, when the yield curve inverted, rates tumbled, financials lagged, and have not been a big participant in the markets broad rally. So, investors and traders are a bit nervous that many of these banks might miss estimates. Again, earnings season kicks off Friday morning starting with the “big banks”. Key levels in the SP are 2925 on the upside. If the market cannot rise above that level look for 2845 as first support. If 2845 breaks, watch out below as a test of the December 2018 lows could come in to play.

E-Mini S&P 500 Jun ’19 Daily Chart

If you would like to learn more about S&P 500 futures, please check out our free Trading E-mini S&P 500 Futures Guide.