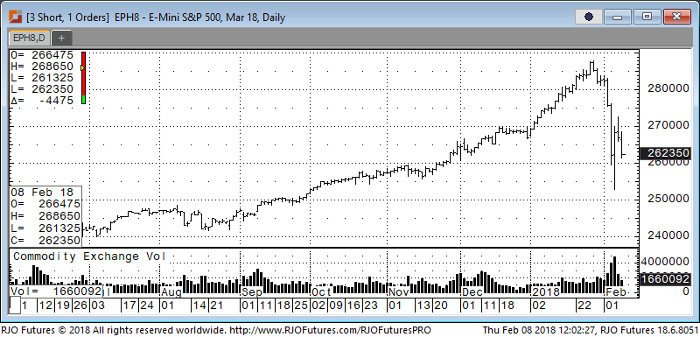

Global equity markets were mostly weaker with Japan and Russia being the exceptions. The normal technical pressures on the equity markets were also fueled by comments from Robert Kaplan, the President of the Dallas Fed, who stated that they should continue to remove stimulus moving forward. It is also likely that global equities are under some liquidation pressure because of the possibility of a US debt ceiling/government shutdown threat even though there are signs of negotiation and progress on that front. The Dow Jones industrial average traded 500 points lower after opening just above the flat line. The 30-stock index also approached 23,778.74, its low for the week. It looks as if the aggressive volatility is set to extend and we can’t rule out at least a quick peek back below 2600 because of the looming uncertainty off the US debt ceiling battle. In fact, even a recovery bounce back above 2700 means little in these current market conditions. Support comes in at 2649 with resistance at 2705.

e-Mini S&P 500 Mar ’18 Daily Chart