U.S. stock futures traded modestly higher Friday morning, with even gains across all four major indices. Stocks seem to be eyeing fresh all-time highs as uncertainty is removed from global markets in the short term, and Chinese negotiators are in Washington for talks once more. If all-time highs are seen again, how much more upside is there?

Economic warning signs continue to flash around the world. Foreign equity markets are selling off as developing economies and seasoned economies struggle to keep up with the U.S. The German GDP is contracting, and Chinese data continues to weaken to multi-year lows. The repo rate is warning of a domestic liquidity issue, which is keeping the dollar elevated, thus deterring foreign purchases of U.S. products. Yes, the American consumer remains strong, keeping U.S. growth steady. However, the saving to investment ratio is high, indicating the consumer does not have long-term economic confidence. Furthermore, we observed a dramatic transfer in the stock market last week as investors swapped growth stocks for value stocks… another sign of caution.

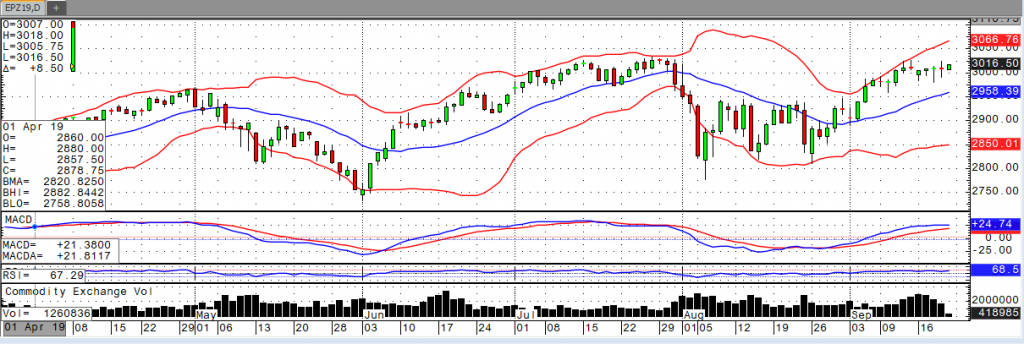

The most recent stock market rally has been funded by REITs and utilities, both defensive groups. Not to mention the fact that domestic manufacturing is now contractionary. The yield curve is flat, and investors still show interest in safety assets. The Fed is cutting rates with stocks near all-time highs and has confirmed that they will roll out quantitative easing when they see fit. So yes, stocks will likely move higher in the short term, but I believe we are in the late stages of economic expansion. Quarterly profits are shrinking and that is one of the best indications of rough waters ahead. A close above 3032.35 in the e-mini S&P hints at a run above 3050, while a close below 2984.25 could trigger a retracement to 2943. Investors beware; any slip-up in trade talks or trouble out of the Middle East could have a dramatic effect on equities.