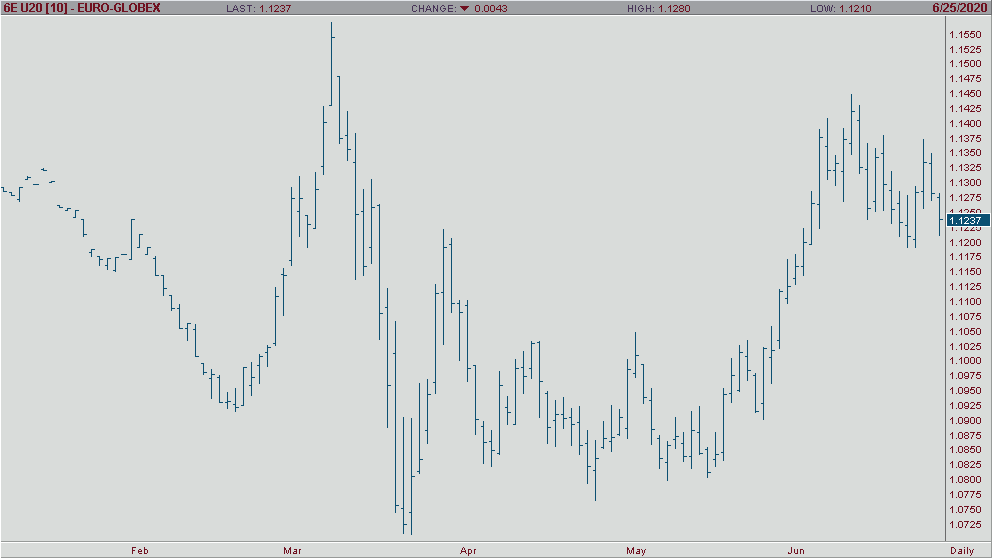

As currencies continue to be devalued through worldwide aggressive stimulus packages and coronavirus cases continue to shutter world economies, the Euro is no exception. Jobless claims throughout Europe continue to look dismal pertaining to Europe’s economic outlook as well, leaving the Euro dropping from near-annual highs. Some may argue that the currency was due for a pullback due to its aggressive spike in recent weeks from optimism rising, however underlying economic outlooks of Europe continue to remain the same, which is overall negative. Technical analysis further shows weakness in the Euro, as prices seem to be declining at an increasing rate across monthly levels. For these reasons, the Euro seems prone to a sharp selloff in the coming days.