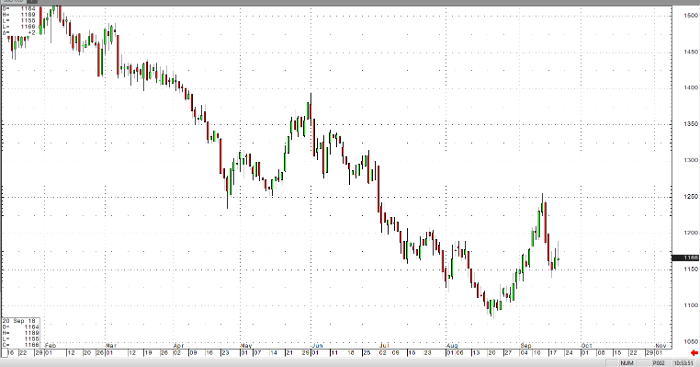

This week’s commentary finds March sugar taking over front month status from the October contract for whose last trading date is September 28. In the last 7 days, the October contract has lost about 400k in open interest while the March ‘19 has gained about 100k. Pretty dramatic change, not to mention the price action! Want to give a workshop on trend-following that includes examples of when that method did NOT work? Take a look at sugar from the last 10-12 trading days. On 9/5 the sugar rally began to get legs and the commodity trading funds who had built a substantial short position began to be pressured by higher prices. By 9/10 the price of October sugar had traded above 11.00 forcing short traders to capitulate and buy back positions. The next two trading sessions saw sugar continue to rally and take the October contract over 11.50 and the March contract 12.50. This forced trend-followers to begin building long positions. However, that is not to say that the entire fund category flipped from short to long as trend-followers only make up a portion of the fund trader category.

Low and behold, three days later the market melted down 100 points stopping out recent longs and placing the trend-follower close to re-establishing new short positions! Epic trend fail. Because sugar is one of the most “trendy” markets, meaning price trends can develop and sustain resulting in positive outcomes for traders who are properly positioned, it can be highly instructive to examine when the method generates results that are not positive. With the permission of our dear readers we will save further discussion of the rigors of trend-following for another days’ market missive.

In the meantime, I would like to freely admit that the drama of the last two weeks price action has me looking at the March sugar chart like a murder mystery whodunit. Why did the market rally, who is behind the volume? Was it commercial participants who started the fire or was it a commodity trading fund throwing in the towel? Sometimes those facts, or fundamental information, can be hard to locate. Luckily, we have technical analysis help us focus on the facts that we can get. Sugar rallied into significant resistance and so far has not been able to hold the rally. In fact, the price action that took both the October and March contracts to recent highs has been soundly rejected. The March contract remains above one of our favorite technical lines in the sand, the 50-day moving average, 11.58, but it looks heavy. Despite the drama, sugar currently rests upon technical middle ground. The recent rally has been rejected, but the March sugar futures contract is holding the 50-day, worth mentioning again, 11.58.

Fundamentally, the Hightower group in recent commentary suggested that Indian sugar exports look to remain elevated with the authorities subsidizing its movement. It is a significant quantity of sugar they are looking to export. Sugar supply so far is ample and looks to stay that way. If you want to engage in forward thinking the question we must ask is, what can reduce the supply of sugar globally? Until that question can be answered it is likely that the path of least resistance is lower, drama or no drama.

Sugar Mar ’19 Daily Chart