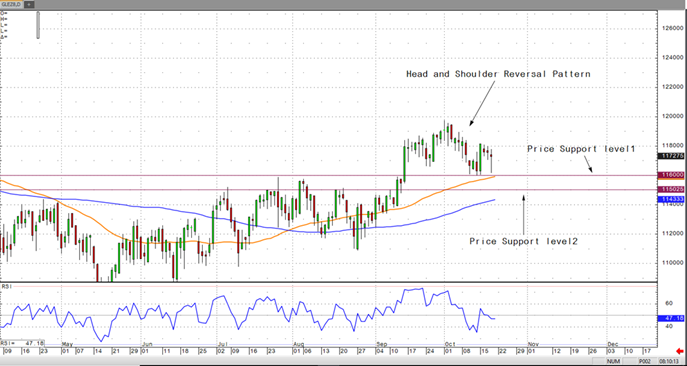

In the December live cattle contract on the daily chart, there is a Head & Shoulder reversal pattern to the downside. A close over the 118.325 level would make this market bullish but trade has hit resistance at the 118-118.500 range. I expect a continued sell-off through the 116.000 support level A breakthrough of the 116 level could lead to a continued sell-off to the 114.500-115.000 range. There is a large amount of market ready cattle out there for the next couple months as the USDA estimated cattle slaughter numbers came in at 118,000 head yesterday, making a total of 352,000 head for the week, far up from last week’s number of 351,000, and up from last year’s number 347,000 at this time. This should be putting some downward pressure on the live cattle prices. Cattle on Feed report comes out today at 2:00pm CDT. Estimates are 100.1% of last year for Placements; Marketing for September are expected at 97% of last year; On-Feed supply on October 1st is expected at 106.4% of last year.

December lean hogs gapped lower, through the 50-day moving average on the open yesterday, and closed at 52.05. I expect the gap to be filled, but sell-off after filling, due to the light demand for pork. Carcass values closed slightly lower and with a significant discount in the Dec lean hogs compared to the cash market which may be a reflection of what traders expect due to the record pork supplies we have late this year.

Live Cattle Dec ’18 Daily Chart