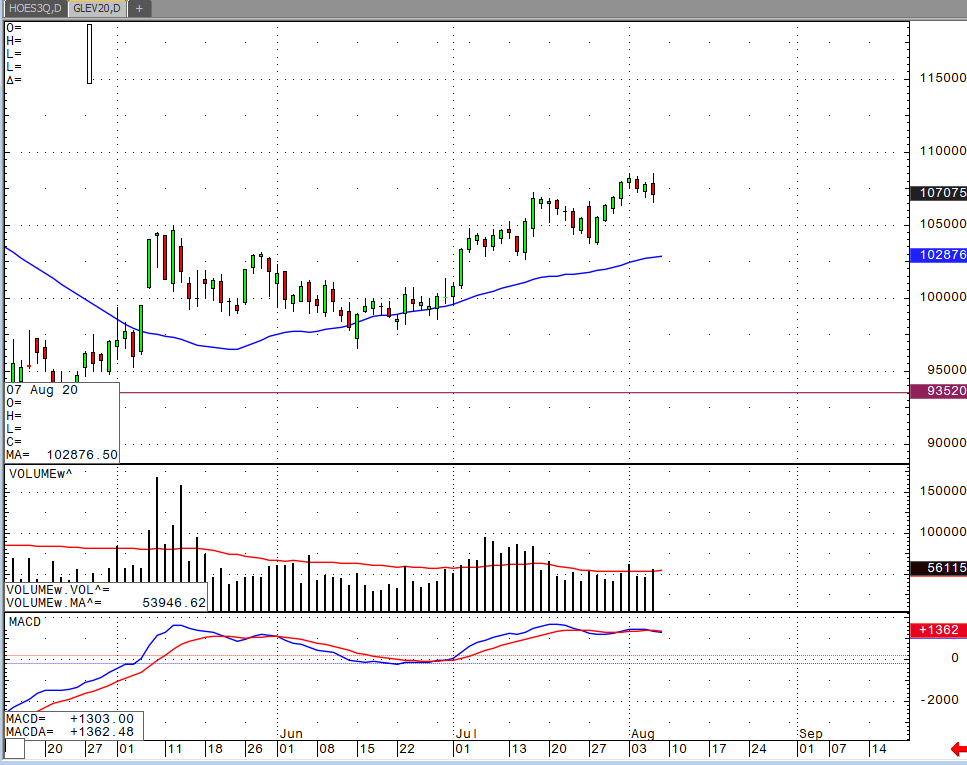

Overall October live cattle still remains in an uptrend but with yesterday’s price action that is triggering some bearish technical signals. I suspect that cash and futures beef prices begin to firm around these levels unless we see the slaughter numbers start to increase and come in above last years numbers. The USDA slaughter estimates came in at 118k head yesterday, bringing the total for the week to 464k which was down about 10k from last week. Boxed beef cutout values were up about $1.09 after the close finishing at $204.66. This was up from $201.80 from last week, the highest levels we have seen since the first week of July.

On the cash end of the market, there has been some heavy trading in terms of volume for KS, NE, and OK with prices 2.5-3 cents higher. People in the market have a strong belief that the cash market is going to rally with the Oct futures above 107 and cash at 100. US beef exports sales for the week ending July 30th totaled 13,366 tonnes. Feeder cattle contracts are trading one shaky ground, higher one minute, lower next and are sitting dangerously close to the resistance levels that were broke through last Friday. As trade continues to panic, the understanding that the feeder cattle charts are topping out is becoming more prominent. August feeders were down $0.92 at $143.87, September feeders were down $0.05 at $146.42 and October feeders were up $0.07 at $147.37. In all, I believe live cattle futures will start to sell off a little bit until we see the slaughter numbers start to increase. A target to step in and buy would be 105.