After four rate hikes in 2018, the Fed has pledged to pause rate hikes in 2019. This could be considered good thing, but it also begs the question “did they pause the rate hikes in time?”. On the short-term the outlook is positive. After the fed declared they would pause rate hikes in early 2019, both bond and equity markets rallied. Some analysts cited pressure from the oval office as the main reason for the pause in rate hikes, but when we look closer we can see there were more pressing factors influencing this decision. The equity markets took a dive at the end of 2018 and it looked like that slide would carry into 2019 before the Fed announced its decision. The yield curve also had a major influence as it was trending towards an inversion and an inversion is an excellent prediction of recession. Obviously, the Fed wants to avoid that and acted as such. On a global scale, another contributing factor is the ongoing trade war with China and an overall slowing of world economic growth. Another interest rate hike would impact the economy with long periods of lags, thus contributing to already slowing growth. Only time will tell if these rate hikes were paused in time, but the short-term outlook seems promising.

Blu Putnam of the CME provides even greater insight and detail in this video. Feel free to check it out for more information

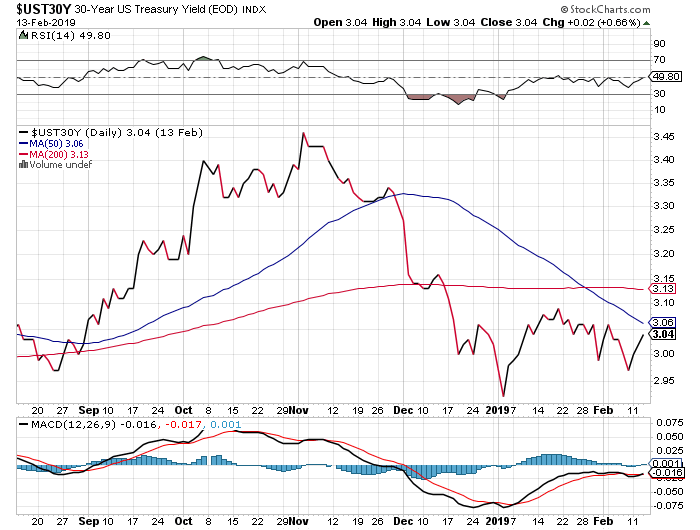

U.S. 30 Year Yield Chart (courtesy StockCharts.com)