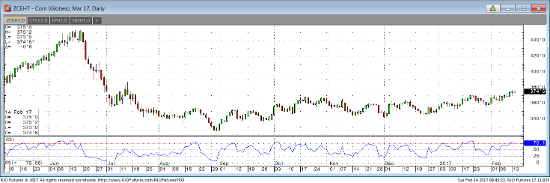

Another new high for the move in old and new crop futures leaves the chart pattern bullish as speculators remain active, or even aggressive, buyers of corn. The market is up for five consecutive days of higher highs and higher lows since Tuesday, and traded to its highest level since July 14th, yesterday. The open interest in corn was up to 42,469 contracts Friday and has increased by 130,431 contracts in the last nine trading days. Exporters announced the sale of 101,600 tonnes of US corn to unknown destinations. In a report from Agisource that surveyed 2,000 producers in six Midwestern states of Iowa, Nebraska, Illinois, Minnesota, Indiana, and Missouri, the US corn acreage will fall to 89.7 million acres. This would be down from 94.0 million acres planted last year. There has been a surge in open interest as fund money has plowed into the corn market. It’s the time of the year when bets are placed, with another US Ag baseline report on Thursday of this week and a fresh 2017 planted area forecast from the USDA outlook conference on Feb 23rd. Look for a set-back to 368 ¾ to 366 ¼ retracement levels over the next few days.