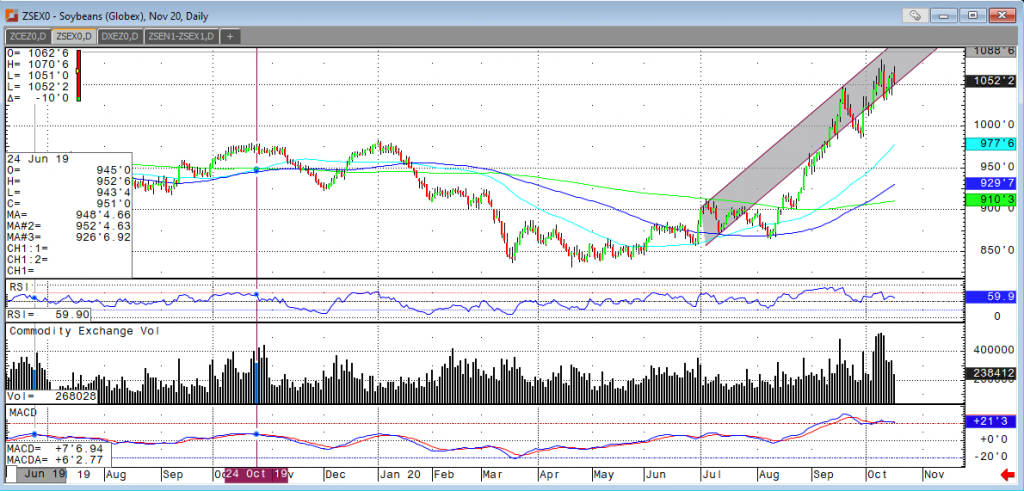

The story was pretty much the same for corn and soybeans this week. Demand, demand and more demand. Exporters announced sales of 261,000 tonnes of U.S. soybeans sold to China yesterday, which helped soybeans recover after taking out Wednesdays low, which is a positive technical development. This makes todays action all the more interesting. Beans traded lower the majority of the day and are currently down 10 cents at the time this article is written. This is most likely due to profit taking heading into the weekend. Overall the trend is still higher and a clear signal is the increase in volume while rallying. This shows there are new buyers or new long positions being added, where as the volume is lower on the down days, signaling profit taking, not new shorts. Today’s close will be an important one. If Nov beans can get below $10.50 and close there, we may see some follow through to begin next week, whereas a rally or better close today will signal more upside. Wheat prices, in my opinion, are the main thing holding up corn today, but the story is similar for corn, which is Chinese demand. If China continues to purchase corn in large shipments, we expect the market to remain supported on pullbacks.

If you’d like to learn about the opportunities that exist in the grain markets right now, please request our exclusive Agricultural Investor Kit. If you have any further questions or needs, please contact Tony Cholly at 1-800-826-2270 or email him at tcholly@rjofutures.com

Our Grain Investor Kit Includes:

– In-Depth Fundamental Analysis and News on What is Currently Moving the Grain Markets

– Technical Analysis Overview with Possible Outcomes

– Analysis on Current Trends and Opportunities in the Market and How to Take Advantage of Them

– Historical Charts and Data Outlining Historic Prices and Trends