Right now, the April live cattle market is short-term bullish and ready for a push to the 128.300 level. If we see a close above this level, that could indicate that there will be a climb to the weekly high of 130 .100. There is some support coming from the frigid weather sweeping through the Midwest making it difficult to maintain cattle weight gains, so once the cold passes the upside may be somewhat limited. Furthermore, there are continued talks of strong packer margins due to higher beef prices which have helped the market keep its bullish trend. Traders are continuing to see poor feedlot conditions and slow weight gains which is causing even more support in the market. The next cattle on feed report is expected to show placements in December up around 1.2% from last year, marketings near unchanged, and January 1st on-feed supply 2.2% above last year. April cattle closed moderately higher on the session yesterday as the market continues to advance on strong beef prices. USDA boxed beef cutout values were up $1.61 at mid-session yesterday and closed 73 cents higher at $218.13. This was up from $216.34 the prior week and is the highest beef market since November 7th. The USDA estimated cattle slaughter came in at 119,000 head yesterday. This brings the total for the week so far to 237,000 head, up from 235,000 last week, and up from 234,000 a year ago.

To learn more, please check out our free Fundamentals of Trading Agriculture Guide.

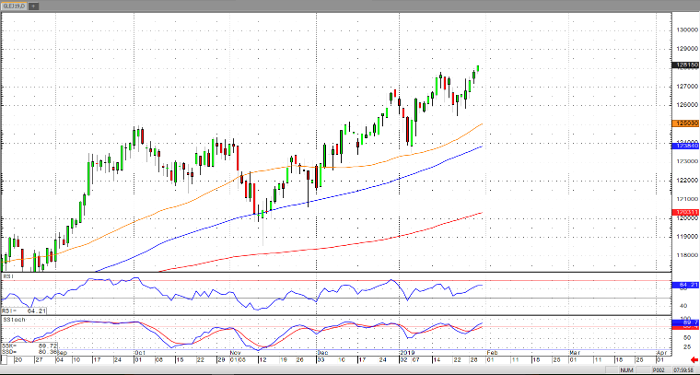

Live Cattle Apr ’19 Daily Chart