Good morning,

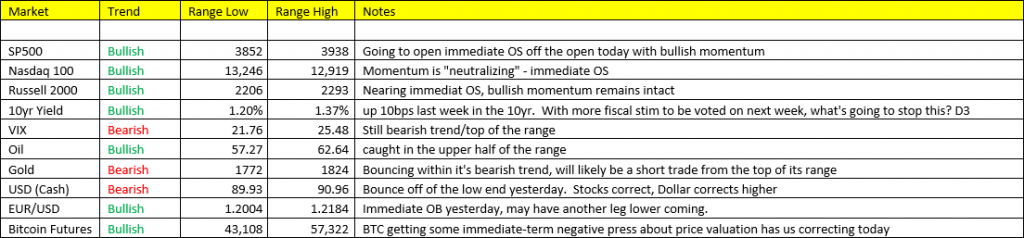

Top? Have we found one? Perhaps. Doubt it. This week is the 1-yr anniversary of the pandemic crash, how endearing for the market to be serving up losses this morning. None of this matters to me, we’re going to continue to look for oversold pull backs to buy for now – as we remain in Scenario 2. I’m not in the business of calling tops and bottoms, I used to think I was that smart…and believe me, that’s not a good approach. More money has been lost betting against this market vs. money lost during the drawdown periods. Tops are processes, not exact points in time. If this 12-month market melt-up is coming to a halt for the intermediate period, there’s going to be plenty of dips to be bought and rally’s to be sold along the way the Scenario 4 in the back half of the year. And to be perfectly honest, even to be discussing a market “top” is an arrogant thought to be holding at the moment. Continue to look for oversold levels to position for long side trades remains our call.

Stocks- SPY -2.5% correction off the top, NQ -6.8% from peak to trough this morning, and the Russell 2000 -4% off the top. Here’s some perspective, The SPY is +82%, NQ +109%, RTY +144% on a y/y basis. So today is not the day to hem and haw over a correction. We remain bullish.

Yields: not much to discuss here, 1.37% and at the top of the range. No movement either with this mini stock correction. Most of you have noticed I’ve reduced our position significantly here, whether this is the right move or not, a lot of money has been made in this call so I’ll make no apologies. I do think we’ll have another opportunity to gross up this position in the spring. Yields remain bullish trend, and will likely remain bullish trend through the first half of this year (and may hold bullish trend throughout the rest of the year despite a Scenario 4 outlook coming in 2H2021, we’ll see).

Dollar- So stocks slide, and the Dollar catches a bid. Makes perfect sense within our positoning model. The fact was, the dollar tapped the low end of the range yesterday and was immediate OS. We’ll see if our call of the USD making an intermediate-term “bottom” is correct or not. For now, we’ll continue to look for OB rally’s to sell into.

Commodities: Corrections in commodities have been few and far between. I shouldn’t have to call out market levels on a daily basis here, you know what’s going on. You have to capitalize on the correction days when they come along. Natural Gas prices look intriguing here….

*Jay Powell at 9am CST

*Consumer Confidence due at 9am CST

Don’t front run me, wait for the signal