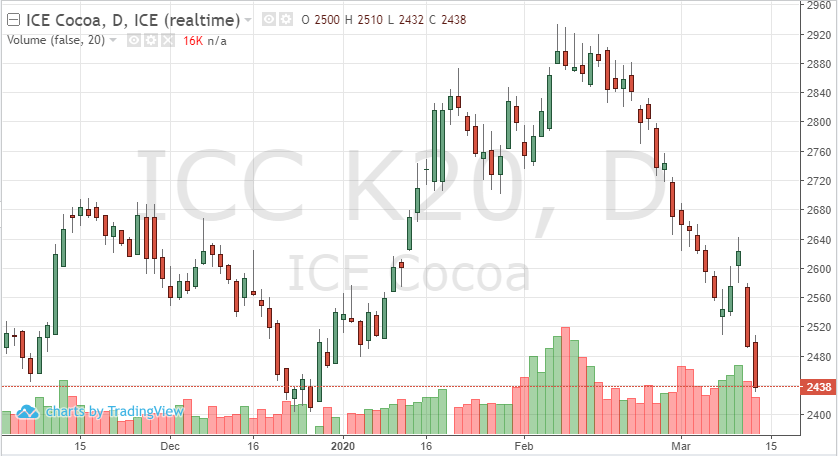

As we continue volatility in every market, cocoa continues to move lower. As the May contract tests lows put in at the end of 2019, demand for chocolate could take front stage for cocoa futures. As the NBA, NHL, MLB and most other professional and minor league sports and teams postpone play until further notice due to the Coronavirus, cocoa could be one of the futures most affected. Since chocolate is a good indicator of cocoa demand and it’s sold at many entertainment venues, this suspension of play could affect futures’ prices.

Each trading day appears to be different as more news breaks daily on the virus. As traders try to position themselves in commodities, a close eye is needed. The fundamentals will control most markets in the near-future, the technicals will provide guidance on quieter trading days. Look to see if 2425 holds and if the cocoa and global markets can recover next week.