Trade wars, global tension and volatility in the currencies all lead to consolidation in many commodities. Traders are seeing the world news carryover first hand in cocoa futures. Supply concerns in cocoa should be providing support but it hasn’t been strong enough to add any follow-through on moves higher over the past few trading weeks. Traders won’t get a good read on Africa’s production for a few weeks – expectations are showing the 18/19 data could help futures’ prices grow. But it does appear that Ivory Coast and Ghana numbers should provide support to the market, especially into the December and March cocoa contracts. There are also reports of pod disease and mold issues in key areas of Africa. This time of year these issues could lead to short-term rallies and adjustments in production levels. Bullish traders should continue to wait on the global volatility and monitor movement in the British Pound. In the meantime, pricing out puts could give traders a short-term view of where prices are headed and exposure if the cocoa market moves lower.

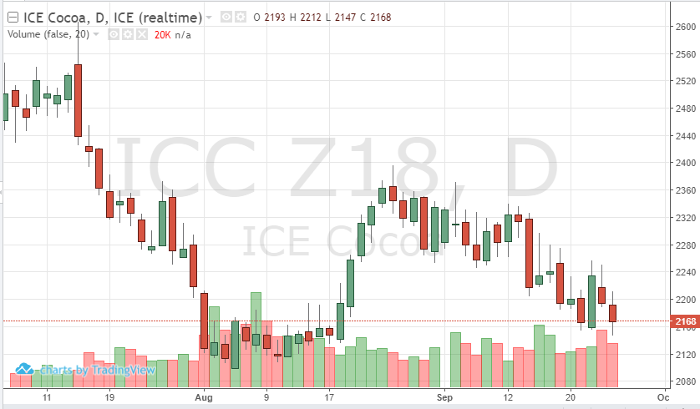

Cocoa Dec ’18 Daily Chart