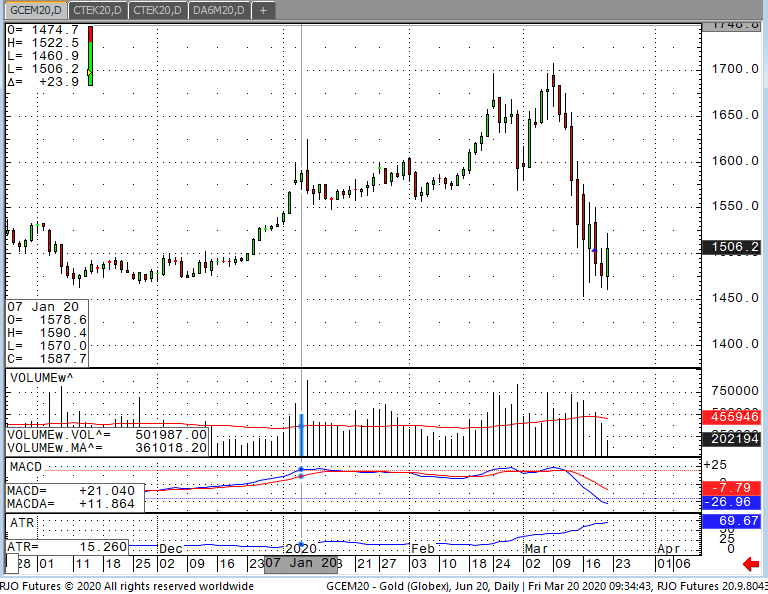

June Gold futures have been anything but a “safe haven” over the past month since the widespread outbreak of corona virus. I’ve heard every theory out there for why it’s not going up when there is an apocalypse going on in the equities. The most “rational” reason that I’ve heard and would to some extent agree with is the issue of clearing commodity and equity asset class exposure and meeting margin calls. Fleeing to cash in other words. I would expect that after the extreme volatility that equities and gold have had over the past few weeks is here to stay.

This presents the question to anyone reading this article of how to profit off these uncertain times in gold. Investors should consider the everyday swings that gold has had with some days being as much as $150 from top tick to bottom tick. On a 100oz futures contract this is quite a lot to say the least. Investors interested in the precious metal should also look at the smaller, 10, 33, and 50 oz futures contracts to manage the swings with smaller accounts. Gold to me has more of a perception of a haven rather than being one and this move proves it in my opinion. The DOW has had several 2000 point plus selloffs in a single day recently and gold dropped severely with it each time, and trended lower as we continued lower in the equities.