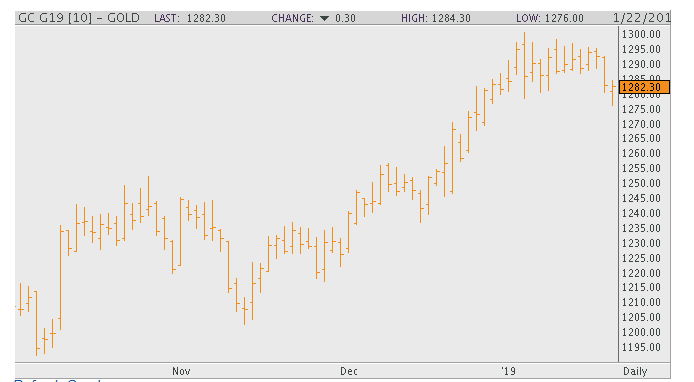

Gold prices are trading down on Tuesday morning. This slide stems from selling pressure due to near-term charts showing deterioration in both gold and silver. This trend is not exclusive to Tuesday morning, as the metals have been under pressure the last few days and are now testing the support level of $1280.

Investors should pay attention to money flow as the day goes on. The housing report came out this morning and showed that existing home sales fell 6.4% in December. This report greatly missed expectations as the season adjusted rate hit 4.99 million units, way down from the expected 5.27 million. This marks the slowest pace since March 2016 and gives further explanation why gold is down .11% today. The crude oil market, which as we all know had a horrific year in 2018, continues its slip into Tuesday and this slip has further affected the metals market. It seems like nothing can go right for gold today.

Taking this into account RJO Futures Market Strategist Phillip Streible said, “gold is under pressure today, practicing a risk-off sentiment would be the way to go”.

We’ll keep watching gold as the day goes on, but right now it does not look good.

Gold Feb ’19 Daily Chart

If you would like to learn more about metal futures, please check out our free Fundamental of Metals Futures Guide.