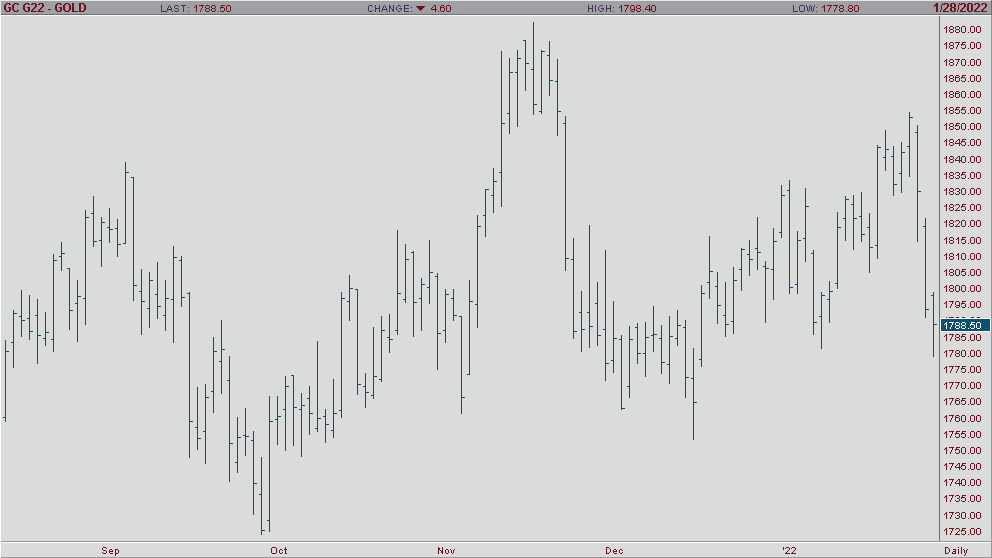

After starting the week strong and reaching a 10-week high on the stock market sell-off, gold futures have fallen of a cliff to end the week. As it stands, we are 3% off Tuesday’s high and tracking to close below $1,800. This is likely due to the hawkish news out of the Fed we saw on Wednesday. The U.S. saw its strongest economic growth since 1984 and that coupled with the news of rate hikes propped the U.S. dollar up the highest level it’s been since July 2020. The Fed rate hikes are supposed to start in March and we’ll have a better understanding just how much they will impact gold then. In the meantime, keep an eye on gold and the USD in the next few weeks. The action we saw during the backend of this week could be an overreaction to the news we got from the Fed on Wednesday, or it could be a sign of a larger trend to come.