In the early morning trade, after a dismal two days, the shiny one has rallied hard back above $1,700 an ounce and is now currently trading at nears session highs of $,1728. This morning’s jobless claims beat estimates of 5-million coming in at 6.6 million people filling for unemployment in the last week. Yesterday, the Feds released their minutes from the March meeting, which basically states that they will leave rates near zero until the U.S. shows signs of a recovery and should surely help to continue to propel gold to even higher prices. Furthermore, the gold bulls, should enjoy news of 450,000 gold miners being sent home in South Africa and could take them 3-4 weeks to get production back up and slowing gold production down this month by more than 20%.

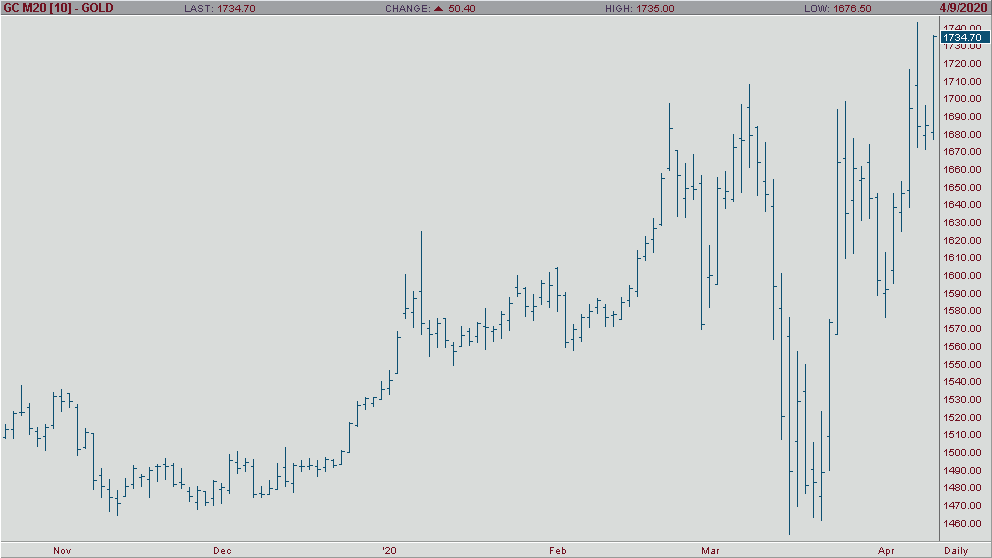

If we take a quick look at the daily June gold chart, you’ll clearly see that during the pull back this week that it held the highs of the week and the bullish trendline along with nearing the highs of the week and flirting with closing at the highs of the week. I’m not sure how many traders/investors alike will want or feel safe going home short gold.