In the early morning trade, April gold is up again after yesterday’s roughly $20 sell-off and $30 off this week’s high. The U.S. dollar is slightly up this morning and the gold bulls have to be pleased that the shiny one is trading higher for the day. It looks like the driving factor in gold right now is the subtle shift in opinion toward the Fed’s stance of being less dovish along with the thinking that economic uncertainty will decline following a trade deal between China and the U.S. If the trade deal goes through with China, one could say that physical demand for gold will go up on hopes of growth and inflation woes. The gold bears can make a case that gold can sell off do to a trade deal causing safe haven liquidation.

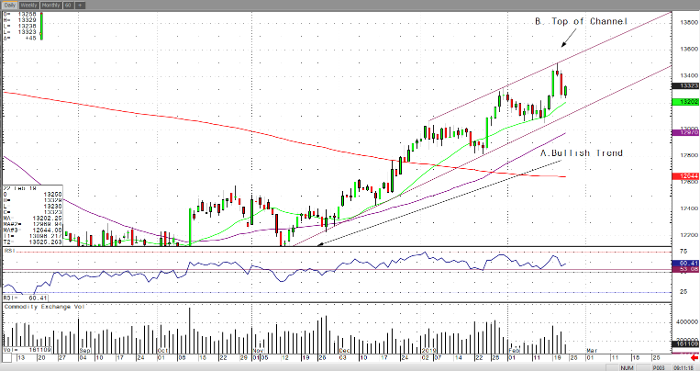

Let’s take a look at the daily April gold chart and keep it simple. You can clearly see the strong bullish April gold that started back in mid-April and a bullish channel since the beginning of the year. For the gold bulls, stay long if you see gold in this channel and above its bullish trendline. For the gold bears, look to be patient a sell at the top of the channel or if it breaks below the bullish trendline.

Gold Apr ’19 Daily Chart

If you would like to learn more about metal futures, please check out our free Fundamental of Metal Futures Guide.