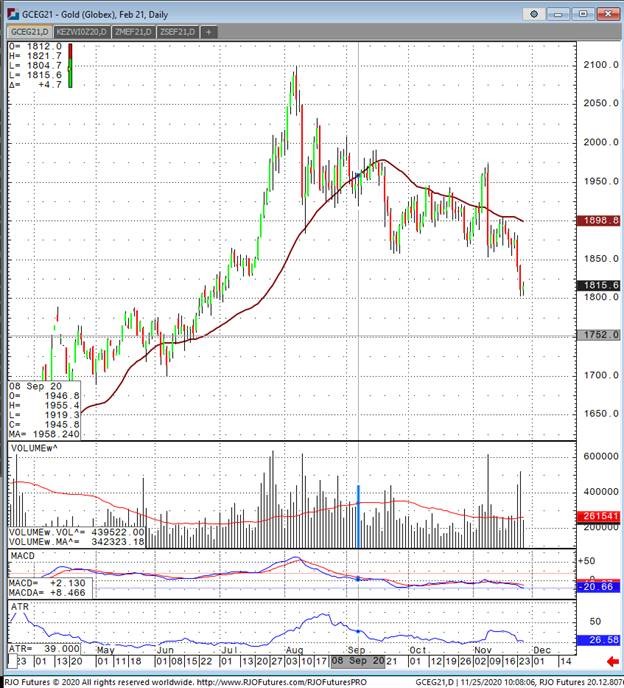

After writing about gold market price action looking weak recently, the market has confirmed my suspicions that precious metals in general continue to look weak, and the weakest of them all being gold. Let’s once again take the noise out of the market and simply look at the technical aspect of how gold is trading. It’s a no brainer that once gold broke a multi month low on Monday at around 1850 (a number I’m sure many traders were watching) the market immediately pushed well through 1800 and even into seven handle range on the December contract. It’s not totally over for gold, there is still some strong support at 1750-1775, but if those get taken out a move to 1700 seems inevitable. I would be positioning myself for a strong selloff soon and covering the position to see how price action trades at around 1750. This is all done on the February contract in gold futures. The only way for me to be bullish gold at this point would be for a significant rally, and close, above 1925. This would be at least giving the bulls a scenario where we are back above 1900, and in a meaningful amount. We would also be above the recent multi week high of just over 1900. Fundamentals are taking a back seat in my opinion, trade the charts.