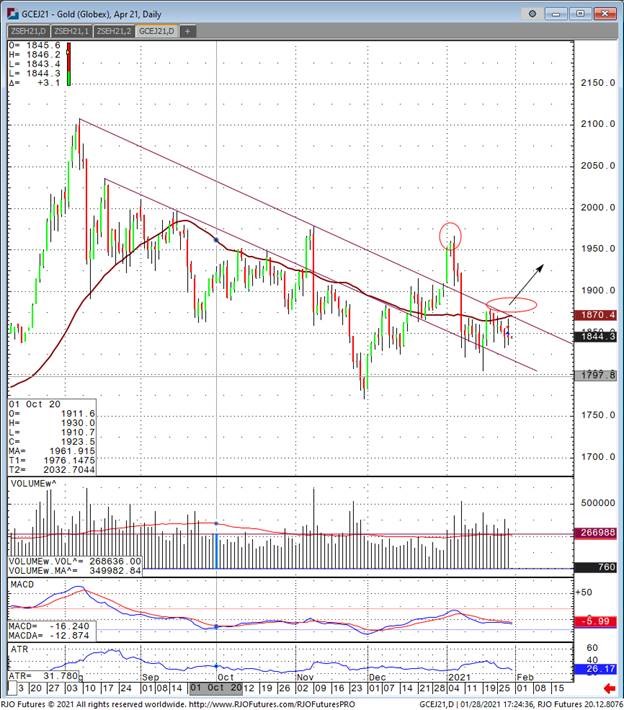

April gold futures has had its fair share of dramatic swings over the past few months. Just when traders thought it was breaking out above 1950 on the way to a 2 handle, the market sold off $140 in 4 sessions. Now it appears gold is ripe for another push higher as an inverted head and shoulder pattern forms and a break above 1880 would signal a break in the channel lower it’s been in. Now, this isn’t the sign to go all in by any means, but it is a sign that 1950 and then the actual high point of 1966 is the next upside target as it’s a multi month high. In my opinion the only way to trade gold is from a position standpoint and hold over the course of several weeks or try and day trade it as the volatility seems to be enough to make money. Silver is stealing the show right now and gold doesn’t have the same industrial and safe haven hybrid use that gold does. I would be positioning long gold from these levels with sell stops beneath the recent spike low of 1804.70. A close or a violation of this level is a signal to anyone shorting gold to step on the gas and a retest of the multi month low tick of 1771 is coming. I’ve heard all of the fundamentals on gold and silver, but technical aspects are more important to watch at this point, and it appears that unless a push above the levels mentioned above happen soon, look out below.