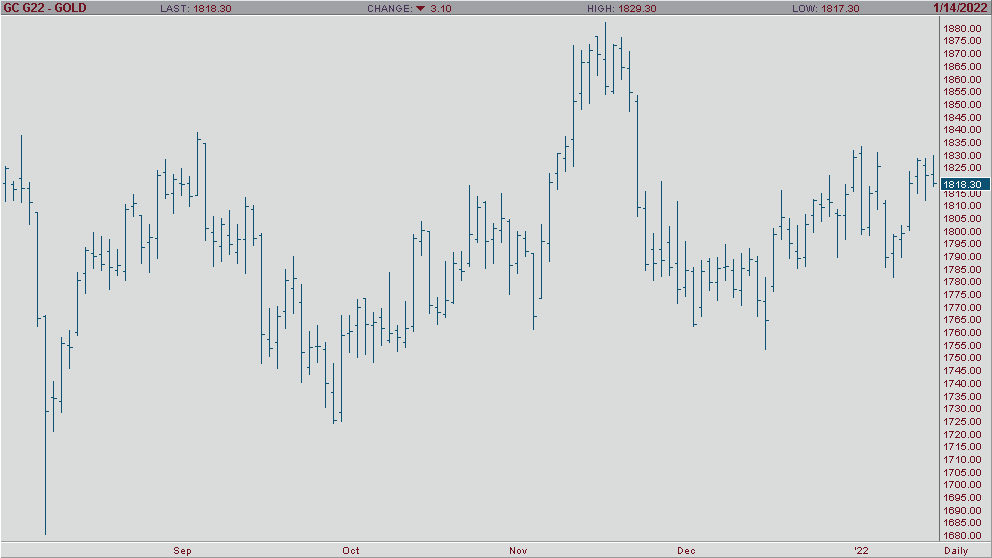

It has been a great week for the gold bulls out there as gold edged higher on Friday looking to complete its best week since November 2021. Gold prices are being bolstered by the weakness we are seeing in the U.S. dollar along with a decline in retail sails and lackluster consumer confidence. While the recent run-on inflation has been bad for most, it has done nothing but help gold. There is sentiment that the Fed will be more aggressive in their plan to raise interest rates to combat inflation in 2022 which would not be good for gold, but in the meantime the market is having a hard time trying to price that in and see it as a reality as we are still seeing rates near zero. After the news of a 1.8% decline in U.S. retail sales we saw gold jump a little bit higher and should everything hold steady we are looking at a 1.3% gain for the week. Whether this week a sign of a larger trend to come or if it’s “fools gold” remains to be seen. Stay tuned for more updates.