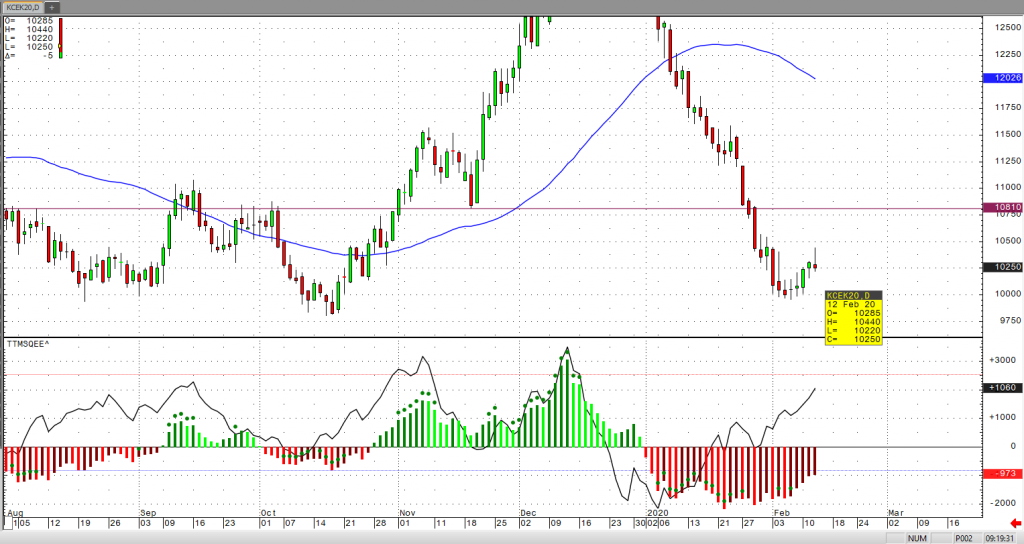

Although May coffee has had an impressive three consecutive days of positive price action, we are still far from having the supply demand support news that is required to rally back to the 108 level. Last week’s bullish roar comes mostly on the heels of short covering. May coffee is still dwelling at seriously oversold levels, but the fact that prices have been able to hold support at the 100 level, and also not challenge the October low of 9815, should indicate a potential for consolidation in the near term.

Our friends at The Hightower Group shared that “Brazil should still have a sizable production increase from the 2019/20 season, but leaf rush and berry borer issues make it less likely that it will reach a record high total.” For any type of rebound (or even support in the near term), traders must hear some good news in regard to China’s ability to stabilize the coronavirus so that more risk capital can make its way to coffee, as I believe it to be a great buying levels at this point.

From a technical perspective, we have been able to hold support at the 100 level and now the 102 level looks to be near term support. I believe this market to be extremely oversold, and with the slightest bit of good news related to not only the coronavirus, but key supply side issues, it could be due for an extremely strong bounce back.