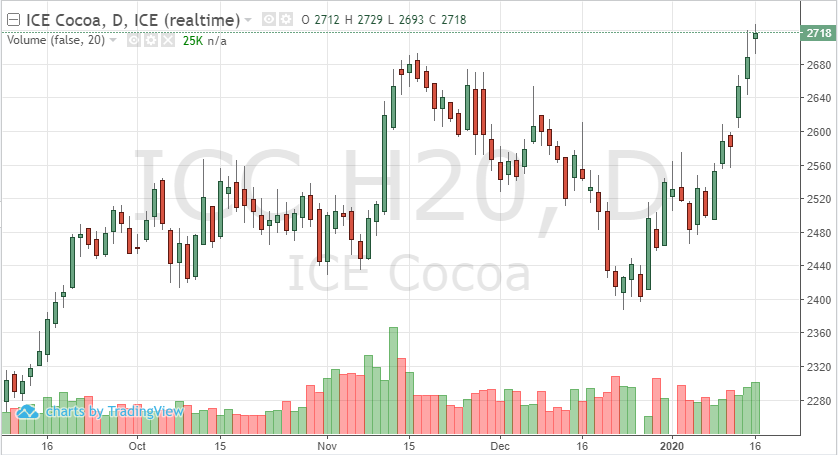

Grinding data this week has cocoa futures testing highs from 2018. The March contract reached 2729 on Thursday. Asian demand increased and provided market support – leading to more speculative buying. European eemand was also up, paired with a stronger Eurocurrency, helped the market continue this follow-through move higher. If the N. American grinding data after Thursday’s close is also strong, look for 2750 to be tested. The street is anticipating a weaker number than other regions though. If this is the case, the market could see pullback back to 2680. If traders are looking for a short-term play, buying puts could be the path to exposure.

Technically, the chart is poised for a move higher. The market continues to close above the 9-day moving average and continues to trade above the 200-day. Support is at 2680 if the market were to pullback if we reach overbought levels. Resistance remains at 2730, above that 2750.

If N. American grinding surprises, 2800 could be touched over the next week. If the data comes inline, look to the currencies and global/political news to guide the cocoa futures again – as well as any tension in West Africa.