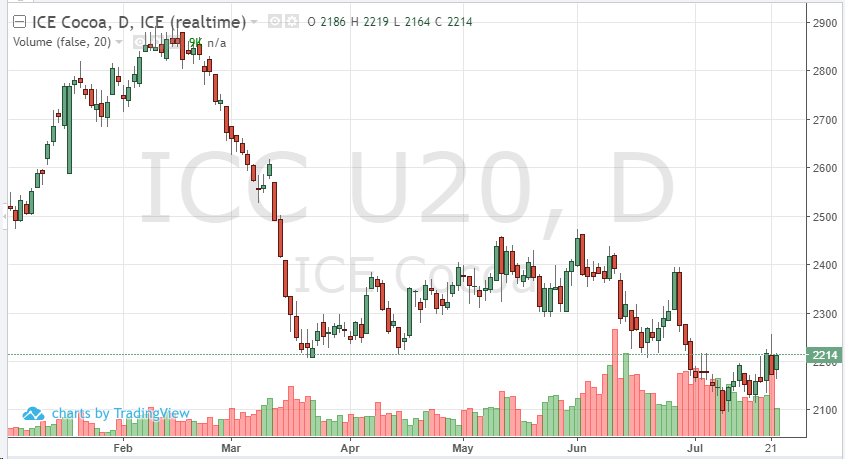

The chart is showing traders that we may have seen the bottom in the September cocoa contract. The past few sessions have canceled each other out, one day up, one day down and so on. Grindings data has caused some of this volatility. Lack of demand and some bullish supply info has also created this recent pattern. As we have leaned on demand news for guidance, West Africa may have enough of a threat to production that prices may be able to find some support. Also, if the global equity markets continue to stay somewhat positive, we may be headed back above 2250. For now, traders should keep an eye on the euro and pound for some additional directional help. The technicals also seem to be back in the picture for cocoa now since the demand concerns seem to be taking the sideline, so monitor the 2250 target and see where the market goes from there.