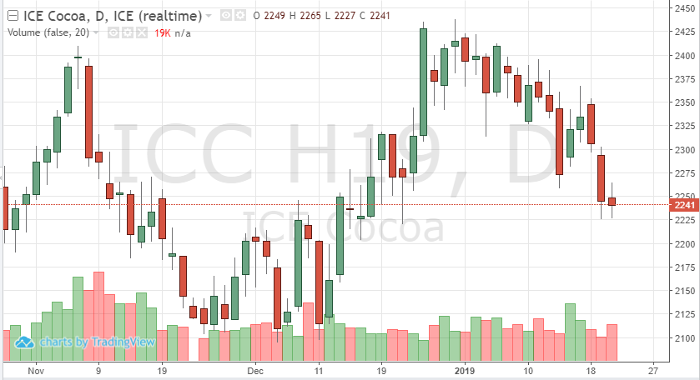

With global trade tension across the globe affecting most commodities, cocoa has also found some weakness. Technically, the chart is turning bearish. The March contract found some support at 2240, but has the potential to break lower off the recent grinding data and weaker demand tone. If 2225 is broken, look for 2160 to be tested. The weaker Euro is also pressuring European demand. Traders are also looking to Ivory Coast arrivals for guidance. With the recent weather fronts in West Africa producing light rainfall, we could see production expectations move higher, also causing concerns for lower futures prices.

While traders continue to trade the March futures contract and position themselves to move into the May, look at upcoming arrival and production data for guidance. Traders will also need to monitor trade talks and the US government shut down which has pressured the markets.

Cocoa Mar ’19 Daily Chart