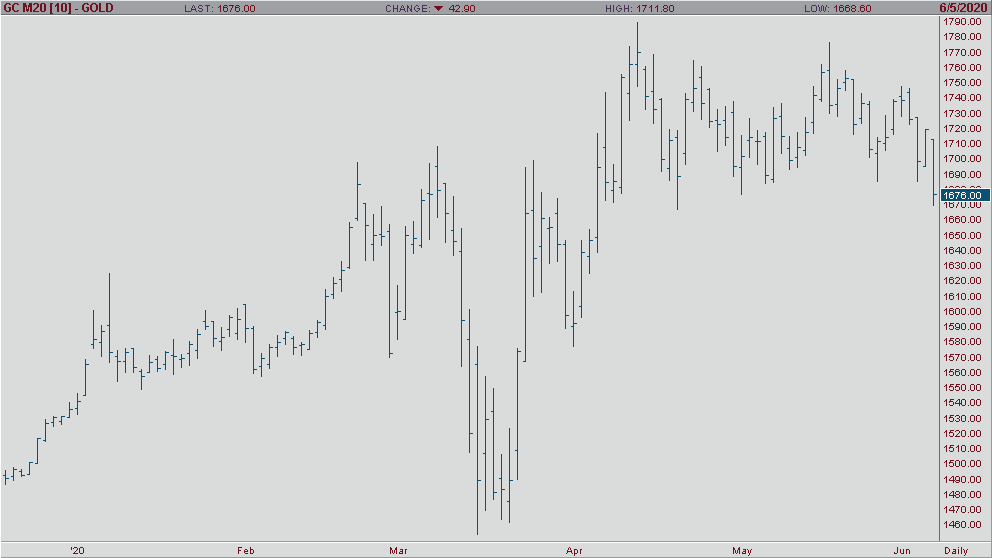

In the early morning trade after better than expected May non-farm payroll number this morning with a reading of 13.3%, gold has sold-off more than $40 an ounce and currently trading at $1681.0. The payroll number was supposed to come in over 19%, so this was seen as a big positive in the big V-shape recovery we are having despite all the recent chaos in this country over the past few months. After this week’s trading and today’s job report, gold has lost some of its safe-haven buying as it broke new weekly lows this morning. Poor global weekly reports and with the EU announcing a 1.3 trillion-euro stimulus package, gold has not been able to get a bounce to hold onto yesterday’s gains hinting the COVID-19 rally could be losing its steam. Look for support in gold roughly between $1670-$1650 or a breakout above yesterday’s high of $1729 an ounce.