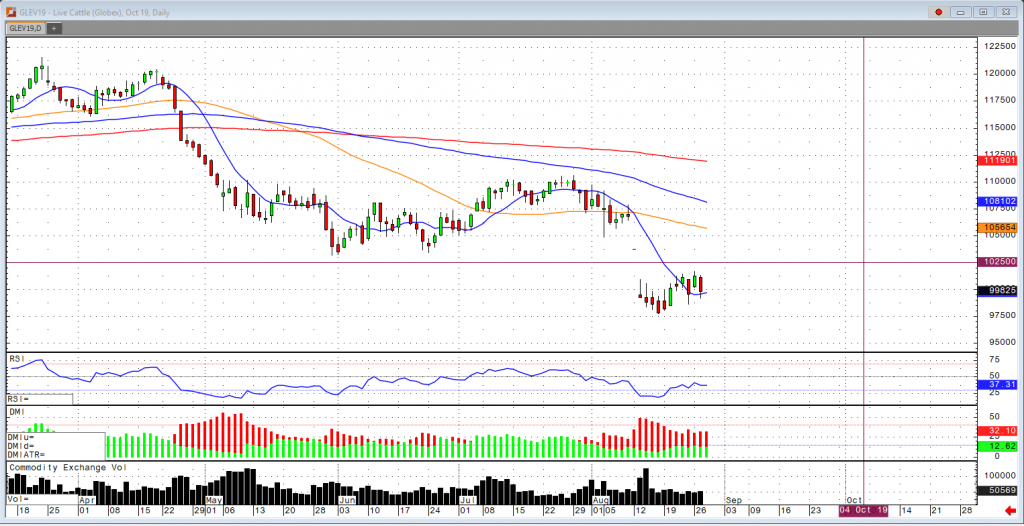

The theme remains the same in the cattle markets right now, there is still a lot of near-term supply which leaves the market in bear territory, but later into 2020 the market should look to turn to the upside. The cash trade in Nebraska had 1,022 head traded at $108-$109 last Friday, compared to $105-$107 the week prior. That begs the question, is the bottom in on the cash market? If you take historical data dating back to 1990, there have only been five years that declines have been recorded of 20% or greater, if you take a 20% decline this year that brings the cash market to $102. Consumer spending has remained robust as beef demand has been the better performer for retailers. One must also realize that core retail spending is now growing at its fastest pace since this data started to be recorded, which is mainly a result of the rising employment and rising wages. Of course, one of the major unknowns going forward is outside demand and the level of beef exports. Due to China’s most recent import tariffs beef exports have been lagging all year. Keep in mind, a 1% decline in domestic beef demand would require an increase of 9% in beef exports to offset that 1% loss. In the October contract, dating back to August 16th, you can see a slight uptrend with higher lows being made and a close above the 10-day moving average yesterday. I still think the near-term market trades up to the $102.500 level but no significant breakthrough as the near-term supply and slaughter numbers are too great.

Last Friday, the cattle on feed report came out and showed that it was in line with trade estimates, with 100.2% increase over last year. Some standout statistics from this report I’ve noticed were that Iowa (-10%), Minnesota (-15%), and Nebraska (-6%) all had declines of more than 5%. While Colorado (+9%), and Kansas (+5%) had increases in their cattle on feed. Placements fell short with only 97.9% being placed year over year and marketing’s had a great performance showing a 6.9% increase year over year. This shows that it will be necessary as a minor increase in market ready cattle supplies will be realized in mid-September. Aggressive marketing posture needs to be maintained to prevent any backlog from developing in October.

The USDA estimated cattle slaughter came in at 116,000 head yesterday. This was up from 115,000 last week but down from 120,000 a year ago. USDA boxed beef cutout values were up $1.58 at mid-session yesterday and closed 54 cents higher at $238.06. This was down from $239.13 the prior week.