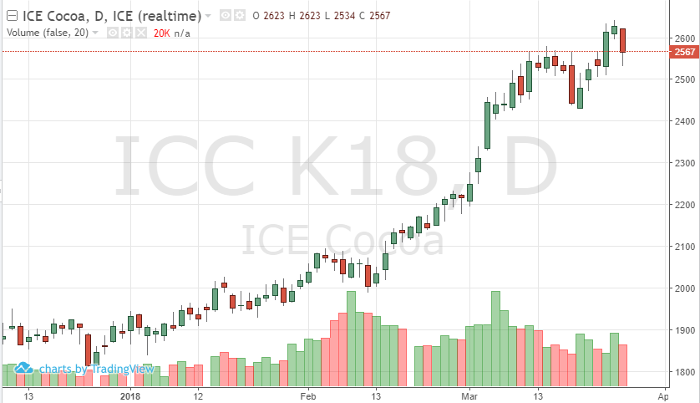

Some traders have been preparing for cocoa to come off the recent highs by buying puts, others have been riding this wave higher as long as possible. Futures prices will need some more bullish news to stay above 2600 even though the chart is showing us the market is building technical support. The May chart has been able to avoid a drop and hold below 2560 – but levels are overbought. A selloff could be in the works if profit-taking grabs a hold of the market as traders start to position further out strategies.

Fresh global demand news will be needed to keep prices at current levels. Currencies continue to add volatility and short-term demand clues as the pound, euro and dollar activity has backed-up moves in cocoa futures. With the shortened trading week due to the holiday weekend and traders exiting their quarterly positions, expect lighter volume and increased volatility.

Cocoa May ’18 Daily Chart