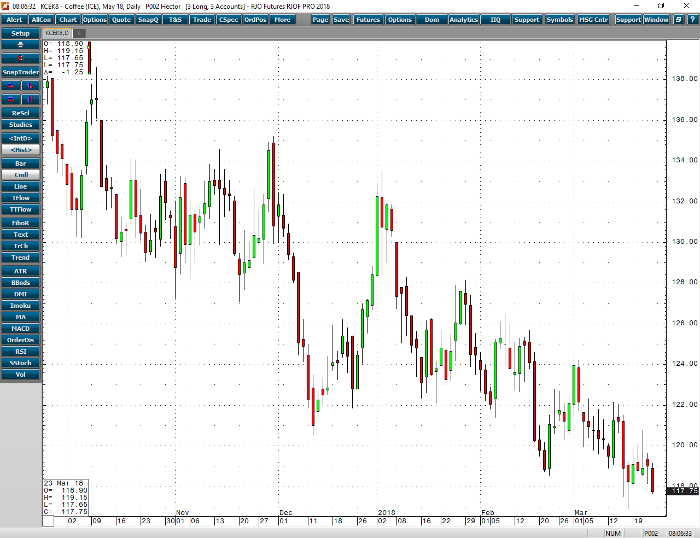

The coffee market has had a very slow week. This is surprising considering how much other markets have moved this week after an interest rate hike and new tariffs introduced by the President. Yet, I still argue that coffee is our next sleeping giant. We have been sitting in between 117.50 and 122.50 most of the month. I would argue this is due to the trades inability to generate news to take it higher or lower in value. Yet, is this true, is there absolutely no reason to find an interest in a market that has been known to move five to ten cents in a day? I say let’s look at the dollar and the possibility that all these decisions from the White House will likely lead to some loss in value and a boost in the value of foreign commodities such as coffee. In addition, let us look at the fact that coffee has been pushed down to its cheapest in years due to a strong push to export as much as possible to cover shortfalls from the 2016 growing season. The closer the May coffee contract gets to 117.50 and 115.00 the easier it is to think that we could have a strong turn around in value. The demand for coffee continues to be strong worldwide and historically we usually do not stay at these levels for very long.

Coffee May ’18 Daily Chart