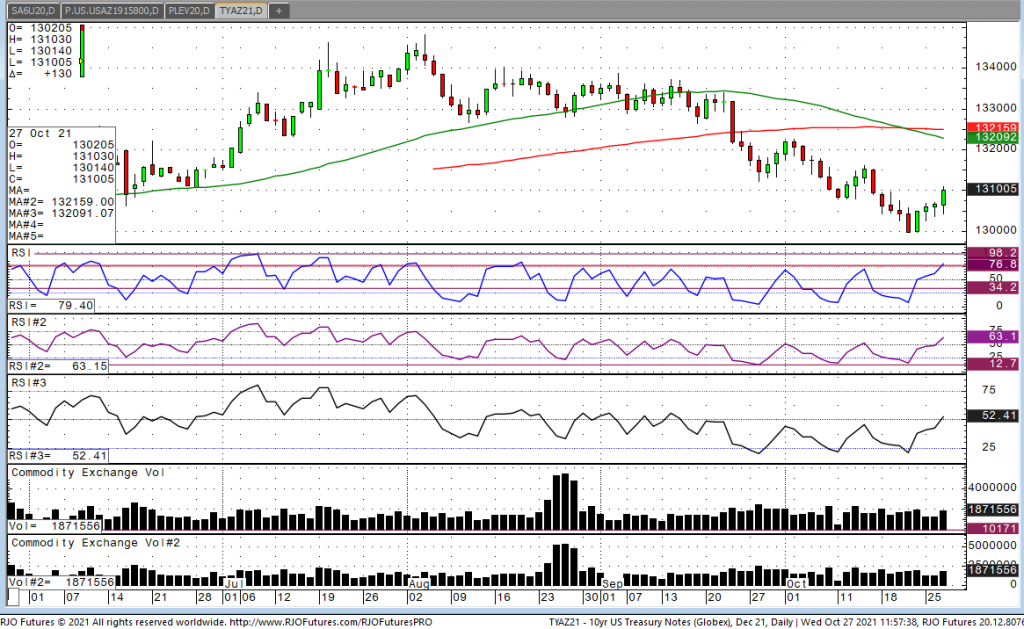

Looking at the December 10- year note, we have a high of 131-01, a low of 130-140, and are currently trading at 131-00. Watching today’s price action is somewhat impressive driven by a softer than expected durable goods number. What we have seen in the last several weeks is continued strength in the economy and better than expected government reports. I don’t believe one weak number changes much for the Fed, who have relayed clearly to the market that they do indeed intend on beginning to taper in November. The market has priced that in already as we’re seeing a weak durable goods number. In my opinion, we caught some shorts and that has exacerbated the move to the upside today. There are rumors the Bank of England is looking to lift interest rates at their next meeting. Investors are keeping a close eye on the continued supply chain disruptions that are forcing prices in many of the commodities substantially higher thus producing inflation which might make the Fed raise rates earlier than most anticipated. Looking at some key levels in the Dec contract, some resistance lies at 131-06 and support coming in at 130-04-02. Traders should continue to monitor any verbiage from fed governors as to clues about the feds thinking.