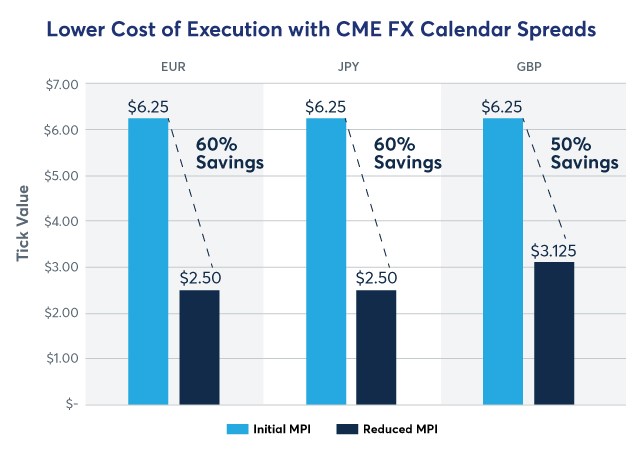

CME Group recently reduced the minimum price increment (MPI) in EUR/USD and JPY/USD calendar spreads ahead of the September roll, building on the recent success in GBP/USD.

Delivering better value:

- Lowering Cost of Execution: With EUR and JPY quoted at 0.2 (vs. 0.5 previously) andnd GBP quoted at 0.5 (vs. 1.0 previously) nearly the entire roll, representing significant cost improvement for end users of 60% and 50% respectively.

- Improving Liquidity: Top-of-book liquidity at the new MPI averages $14bn in EUR, $10bn in JPY, and $11bn in GBP, providing more than sufficient liquidity for participants to execute large size quickly without price slippage.

- Transparent Electronic Marketplace: Traded via central limit order book, CME’s all-to-all FX futures marketplace, offering immediately executable liquidity with full price transparency.