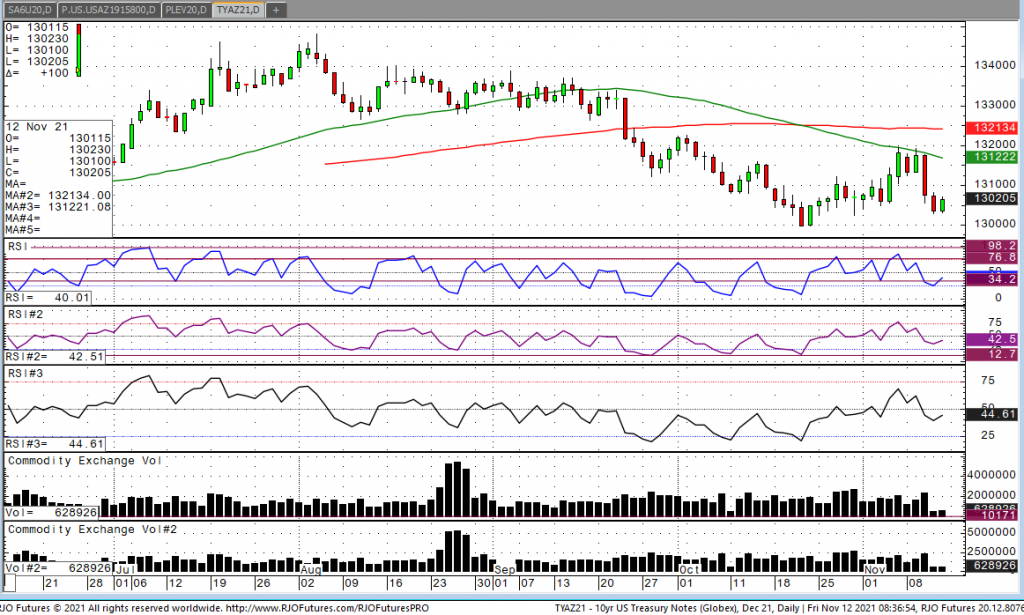

Looking at the December 10-year note, we have a high of 130-23, a low of 130-10, and currently sit on the highs at 130-23. The market feels like it’s digesting the big news that we saw on Wednesday where CPI came in much higher than forecast and subsequently pushed the yield on the note sharply higher and prices lower. Let’s face it, numbers don’t lie. Whether one goes to the grocery store, gets into a car and drives, or travels by plane, one is getting pinched by higher prices across the board. As the Fed continues to say that this up move in inflation is transitory, many are getting hurt and need to see prices lower for the consumer to resume spending. The problem that many are facing is that this model the fed created doesn’t work. As wages are stagnate, meaning they aren’t increasing as prices go up, the middle to lower class is getting destroyed by this move up in consumer prices. They don’t care if it is being caused by bottle necks in the economy or the fed asking OPEC to increase production, people need relief now and not later. The fed caused this and are to blame. The continued printing of money and talk of a gigantic infrastructure bill, has led to a to the sharp increase in prices that consumers are eventually paying for. With unemployment near pandemic lows, and rates near zero there is no reason at all for the fed to continue the process of printing money to keep rates artificially low any longer.