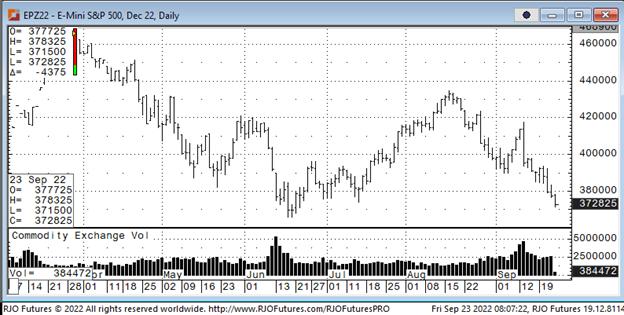

Stock futures are sliding this morning setting up a huge losing week on fears of the aggressive Federal Reserve policy. These actions have also sent the Treasury yields in a steep climb to new highs. The Federal Reserve on Wednesday raised benchmark interest rates by another three-quarters of a percentage point and indicated it will keep hiking well above the current level. The consensus is another 1.25% before the end of the year. Trying to bring down inflation which is running near its highest levels since the early 1980s, the central bank set its federal funds rate to a range of 3%-3.25. This is the highest it has been since early 2008 and was the third consecutive 0.75 percentage point move. The Fed started increasing rates back in March when the base rate was near-zero. This has been the most aggressive tightening since they started using the overnight rates as its main policy tool back in 1990. It has been said all along that they would do whatever they felt necessary to bring inflation down. “My main message has not changed since Jackson Hole,” Powell said in his post-meeting news conference, referring to his policy speech at the Fed’s annual symposium in August in Wyoming. “The FOMC is strongly resolved to bring inflation down to 2%, and we will keep at it until the job is done.”