The overnight global equity markets were mostly higher with the RTS index and the IBEX being the exceptions. Other than the original complaints from China on fresh 200 billion tariff levy initiated by the US this week, the Chinese have not had an official response yet, and that has eased some of the investor anxiety. Delta Air Lines and Commerce Bancshares will announce their earnings before the Wall Street opening Friday. With the early action Thursday morning showing a positive track following a two-day high to low setback of 32 points, the E-mini S&P could be poised to start a rally back to the July high of 2797. The bottom of the anticipated near-term trading ranges looks to be 2764 and a near term resistance levels at 2800.

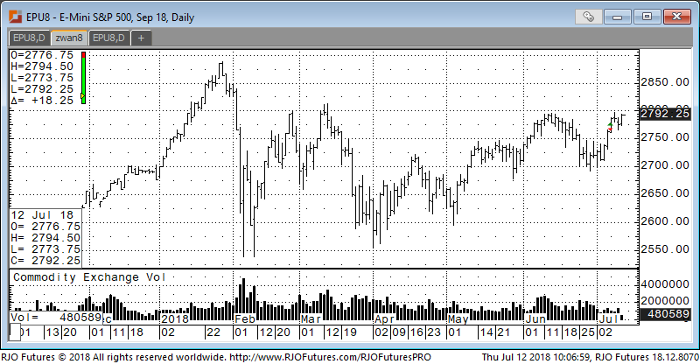

E-mini S&P 500 Sep ’18 Daily Chart