After yesterday’s World Agricultural Supply and Demand Estimates, the general consensus has seen a stable or shrinking stocks (for corn, wheat, and beans), while trade has responded in kind, the market seems quite comfortable with current levels at this time. There was not much “call to action” in part of the bulls, given the response from trade numbers, and the market seems unwilling to commit to changing its current price dynamics.

Projected Wheat ending stocks were raised by 20 million bushels, siting that higher food use is being more than offset against lower export numbers. The report goes further, adding that there is still an anticipation of exports improving in the near future, but reported U.S. ending wheat stocks of 1000 million bushels. Wheat supplies also increased globally, primarily on higher production forecasts for South America and Eastern European “bread baskets”. Global trade saw an increase as well, with the increased exports from Russia, Argentina, and Canada covered the reduction in exports from the EU and the United States. Regional consumption and demand for wheat has also shifted, with Indonesia surpassing Egypt (the historical leader) in net wheat imports.

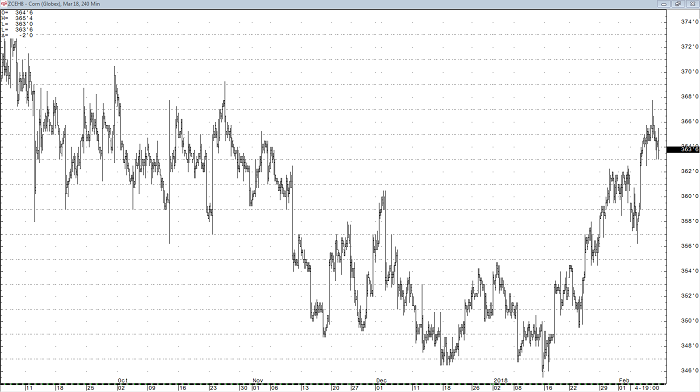

Corn’s projected ending stocks were reduced while exports revised higher, as the January WASDE suggested U.S. price competitiveness as well as reduced exports for both South America and Ukraine corn belts. The net change resulted in U.S. corn stocks being revised lower by 125 million bushels from last month’s report to 2352 million bushels. Global corn production is projected to drop by 2.3 million tons to 1321.9 million tons. Lower production from Argentina (sighting persistent heat and dryness), and Ukraine are keeping production in a slump, and have the potential to create a larger demand for U.S. coarse grains. The global corn balance sheet also saw a drop in ending stocks by 3.5 million tons from last month to 203.1 million tons.

Soybean’s projected ending stocks, like corn, were increased while exports revised lower to 2100 million bushels, down 60 million from last months report. The net ending stocks for U.S. soybeans was reported as 530 million bushels, and is generally in line with many experts expectations. Crush expectations remain unchanged, and soybean ending stocks were raised by 60 million bushels to 530 million bushels. Global oilseed production was noted as being 1.5 million lower, with soybean production partially being offset by higher cottonseed crushing. Global soybean production was reduced by 1.7 million tons to 349.9 million, unable to be offset by an expected rise in Brazil’s production to 112 million tons (2.0 million tons higher), with favorable weather conditions in Brazil keeping yields afloat.

Corn Mar ’18 240min Chart

Soybeans Mar ’18 240min Chart

Wheat Mar ’18 240min Chart