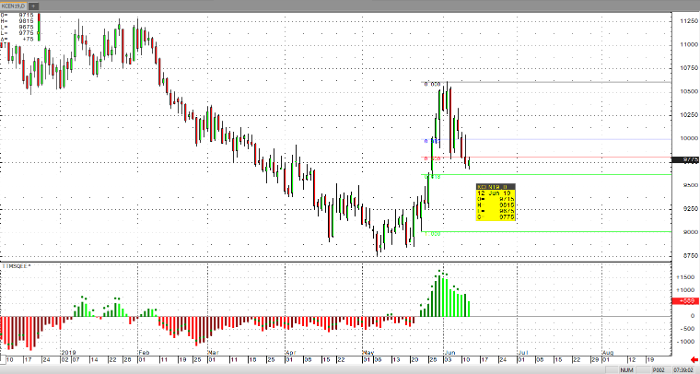

We’ve seen a very strong pullback in July coffee prices, after a rally topped out at the 105-area in drastic fashion. In addition, July coffee prices have violated the 50% retracement level measured from the breakout low of May 23rd 9020 low to the June 4th 10615 rally high. Granted, strong rallies need strong corrections, but we’re quickly approaching the Fib 61.8% retracement level and if violated, longs should consider stepping aside for a bit. Without any major bullish change in the Brazilian crop supply story, I would expect that support will be found at the 100-area and then get boring for a while (consolidation). Expect that a return to the 105 level (and resumption of the intermediate uptrend) will take some time.

Recent strength in the Brazilian currency prompted underlying support for July coffee prices, but The Hightower Group has reported today that “coffee found little benefit from a more than 1% gain in the Brazilian currency as Brazil has significant old crop supply left to market while their current harvest is nearly 20% complete”.

In nutshell, very sluggish supply news for coffee prices, coupled with demand uncertainty evidenced by the ongoing struggle for the S&P 500 to break above (and hold) the 2900 level.

Coffee Jul ’19 Daily Chart