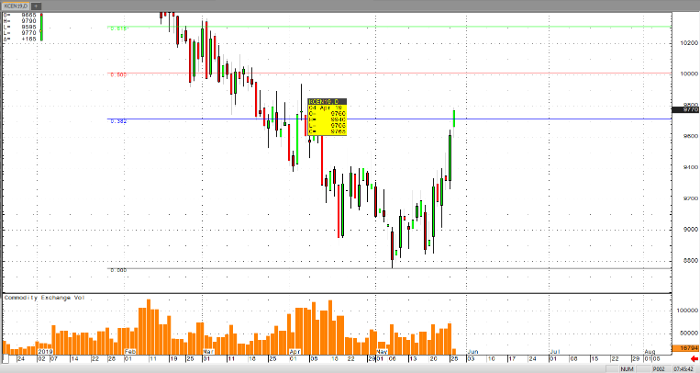

July coffee prices have rallied 38.2% retracement from the last major sell-off on April 30th, at the 9950 area. This same area should provide formidable resistance, but outside forces are providing some level of support to this move. Although July coffee prices have been trading in a well-defined range between 9500 and 8800, we have broken above this range and are currently trading around the highs of April. The Brazilian currency is strong, while the June U.S. dollar continues to struggle to break above the 9825 resistance level.

The Hightower Group reported today that “a cold front moving across Brazil’s coffee regions brought storms with reports of damaging hail in some of the Brazilian state of Parana’s western coffee areas over the weekend”. If in fact the hail damage turns out to be serious enough to affect the crop, we will likely see July coffee prices hold some support above the 9500 level and prior range.

We will all keep in mind that while the U.S. stock market continues to struggle, with the S&P trading below the 2800 level, we will expect demand will continue to be slow for a little while.

The outlook on July coffee prices remains bearish and I would expect some resistance at the 9900 level in the near term. With such volatility on the horizon, I would advise using options to manage risk and gain exposure to the potential resumption of the current downtrend in July coffee prices.

Coffee Jul ’19 Daily Chart