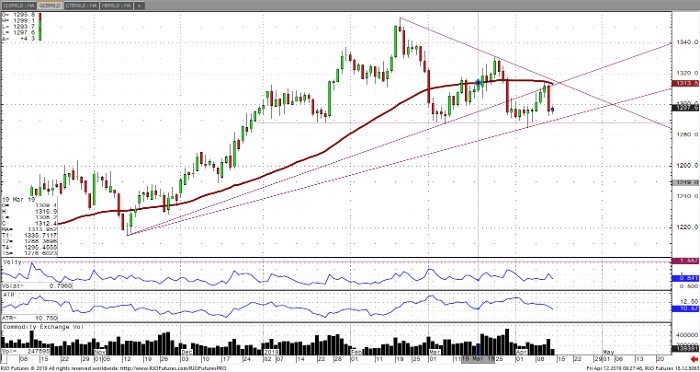

June gold futures has struggled to maintain any meaningful rally above 1350 in recent months. The most recent run to 1330 once again proved the car was out of gas once positive economic and jobs data came out showing unemployment at 50-year lows and strong jobs data the week before. Yesterday gave the bulls a jolt as gold saw a $20 washout below 1300.

To understand where gold prices are likely to head you must look at the overall sentiment in the market, the fundamental economic data, and the overall technical indicators of a chart. Right now, sentiment in the market points to more risk on attitude, and strong confidence in the economy as whole. Clearly, there is no fear of inflation as that’s been in check and just below the Fed’s target of 2%. There is no fear of geopolitical turmoil or North Korea situation like in the past. There is no real catalyst that out there right now that could push gold to new contract highs, in my opinion. There is also enough uncertainty with how much farther the stock market can go and traders are likely on the sidelines waiting to buy gold immediately following a stock market correction.

The technicals of the chart show that 1285-1290 is an area that needs to be broken to push the bulls to cover long positions. A close above 1330 (most recent high) would push bears to cover longs and give them pause to be short. June gold is currently up $5 on what could just be the usual price action between a weaker dollar and more money put to safe havens such as gold.

Gold Jun ’19 Daily Chart