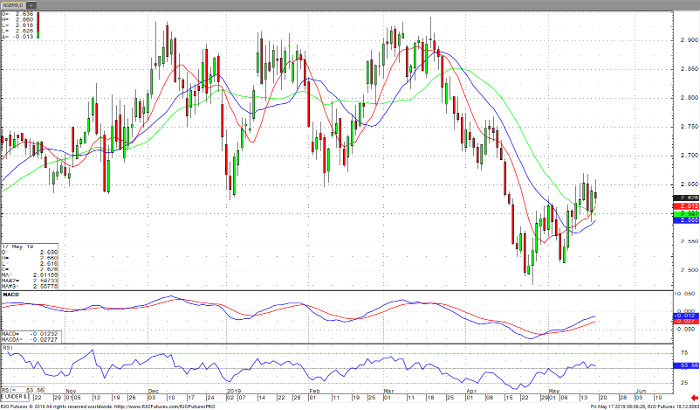

Natural gas for June is continuing in a slight uptrend. Resistance is seen at $2.670 then above at $2.700. Support is near $2.450 then again around $2.500. A close under the $2.574 level is needed to stop the bull trend. A close under low support level should turn the trend to bearish. Momentum studies are above 50% and still climbing. This should accelerate a move in the direction of the trend. A close above the May 14 high, $2.67 opens the door for a run to $2.700 and realistically $2.750. Short-term moving averages are turning to the upside.

June natural gas is at a crossroads in seasons. Cooling season might put an early jump in prices as warmer weather rolls in to the Southeast. Bearish storage numbers in Thursday’s EIA report have been pushed aside as the trend to the upside has resumed. The market is still below the 5-year average and might be ready to jump to the upper ends of the trading range. $2.760 and above could make way for a blow off top.

Natural Gas Jun ’19 Daily Chart