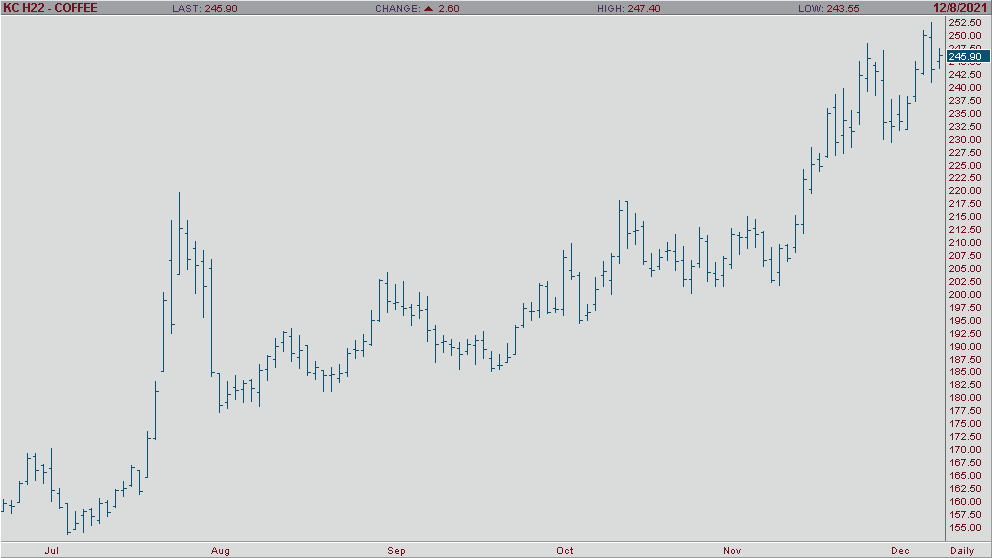

While coffee’s supply/demand outlook is still bullish, a likely record sized net spec long position has left the market vulnerable to profit taking and longs liquidating their positions. After reaching 10 year highs, coffee made a sharp reversal to the downside with a daily key reversal. When the market could not rally on Colombian production decline, however, a wave of profit taking and long liquidation took the coffee market well below its highs by the close. Guatemalas November coffee exports came in 56% above last years total, which is due in part to the increase in global demand since mid year.

The reversal yesterday is a short term bearish indicator. Momentum studies are trending lower from high levels which should accelerate a move lower on a break below support. The next are of support hits at 23750 and 23345, while resistance is at 24900 and 25650.