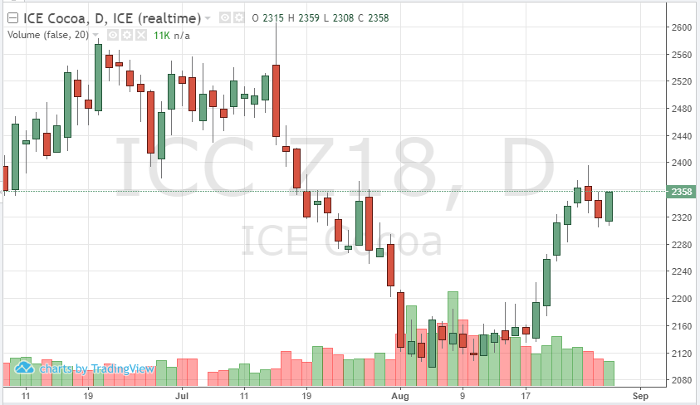

After Wednesday’s move higher, 2300 in the December cocoa contract has been surpassed. The next level of resistance, 2355 was also broken. With a close of 2358 Wednesday, this recent reversal could continue. Although the market hit overbought levels, bullish long-term traders think there is enough long-term fundamental concerns in the crop to add to positions. Supply/demand news has been volatile but there is very little chance that production numbers will recoup enough to pressure the market. If transportation blockage starts to affect key growing areas’ ability to move their cocoa, prices may reflect this short-term issue. Weather premium may also be added to the equation this time of season. Look for 2400 to be the next target level. After the COT data is released Friday, we will have a better idea of how traders are positioning themselves heading into September. Demand releases from corporations will also play a factor into cocoa prices as we enter the end of Q3.

Cocoa Dec ’18 Daily