Cattle demand remains in question and will remain in question until there is more certainty about the coronavirus, at least for the near term. If the consumers continue to have a “go nowhere/do nothing” kind of attitude, then not only does the demand fall, but there will be a backup of supply for both the short-term and into the year. At this point, any rally in cattle look like an opportunity to short the market. After yesterday’s sell-off of nearly 265 points, the market is technically oversold, but I think the fundamentals outweigh the technical in this situation because the spread of this coronavirus across the U.S. could continue to curtail beef demand. The USDA boxed beef cutout was up $1.25 at mid-session yesterday but closed just 9-cents higher at $206.62. This was down from $207.47 the previous week and down from $223.55 a year ago. Cash live cattle trade has been quiet this week, with no trades reported as of Tuesday afternoon. This follows declines of roughly $5/cwt last week. The USDA estimated cattle slaughter came in at 124,000 head yesterday. This brings the total for the week so far to 245,000 head, up from 242,000 last week at this time and up from 238,000 a year ago.

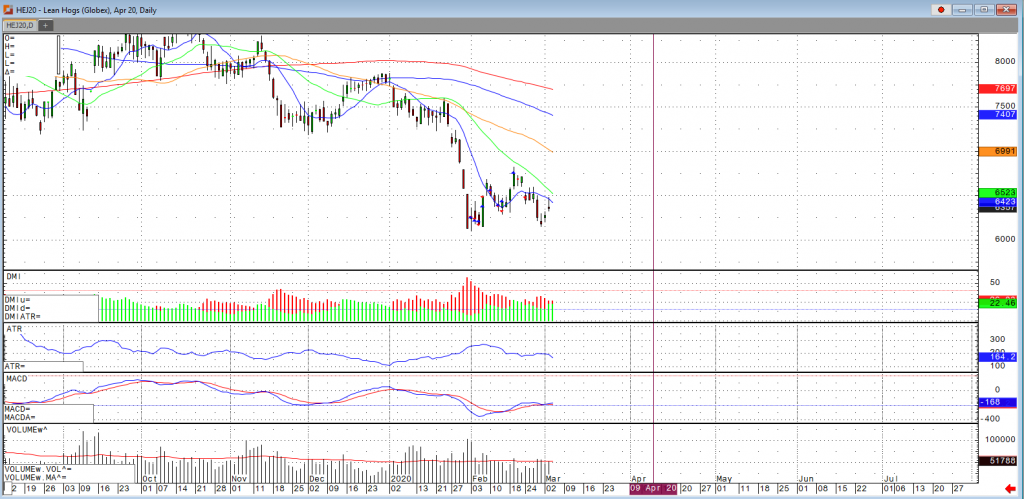

Surprisingly, lean hogs seem to be avoiding this virus mainly due to export shipments remaining strong. If they continue to do so, then the market looks poised for a nice recovery off the Feb lows. April hogs are still holding a substantial premium over the cash market at this time and with the drop in production, this appears to be justified. The CME lean hog index as of February 28th came in at 56.25, down from 56.33 the previous session but up from 55.91 a week before. The USDA estimated hog slaughter came in at 495,000 head yesterday. This brings the total for the week so far to 990,000 head, unchanged from last week, but up from 938,000 a year ago. The USDA pork cutout, released after the close yesterday, came in at $64.84, down 80 cents from $65.41 on Monday and down from $65.03 the previous week.