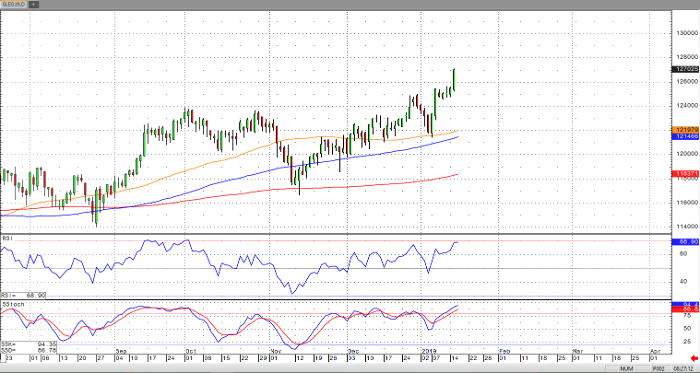

Cattle broke out to the upside yesterday. This aggressive buying action and higher close is due to fear that weather is going to disrupt the market in the plains region, along with a lot of short covering. The Texas and Oklahoma region shouldn’t see any type of significant weather for the rest of the week, but Kansas City should be getting some more heavy snow. As of 3:00 pm Tuesday, there has been a standstill in the Southern Plains and in Nebraska. There was inactivity in the western cornbelt due to very light demand. With a new contract high being made yesterday, the stochastics are entering the overbought levels. The RSI is still below any over buying indication, signaling to me that there is still some upside potential in the market, with a target to the 128.000 price level. USDA boxed beef cutout values were up 56 cents at mid-session yesterday and closed 19 cents higher at $212.21. This was down from $213.98 the prior week. The USDA estimated cattle slaughter came in at 120,000 head yesterday. This brings the total for the week so far to 239,000 head, up from 237,000 last week at this time and up from 233,000 a year ago.

Live Cattle Feb ’19 Daily Chart

If you would like to learn more about agricultural futures, please check out our free Fundamentals of Agricultural Futures Guide.