Last Friday’s cattle on feed report was a bullish report which showed that actual placements for the month of August were down 9% from last year vs. trade expectations for down 5.9% from last year. This leaves September 1st on-feed supply down 1.3% from last year and trade expectations down 0.7% from last year. Trade reflected these numbers on Monday’s session and early Tuesday before a bearish technical signal showed itself yesterday, with an outside down day along with a turn in consumer confidence added to the already bearish tone. The trade negotiations could cause some short selling in the market today.

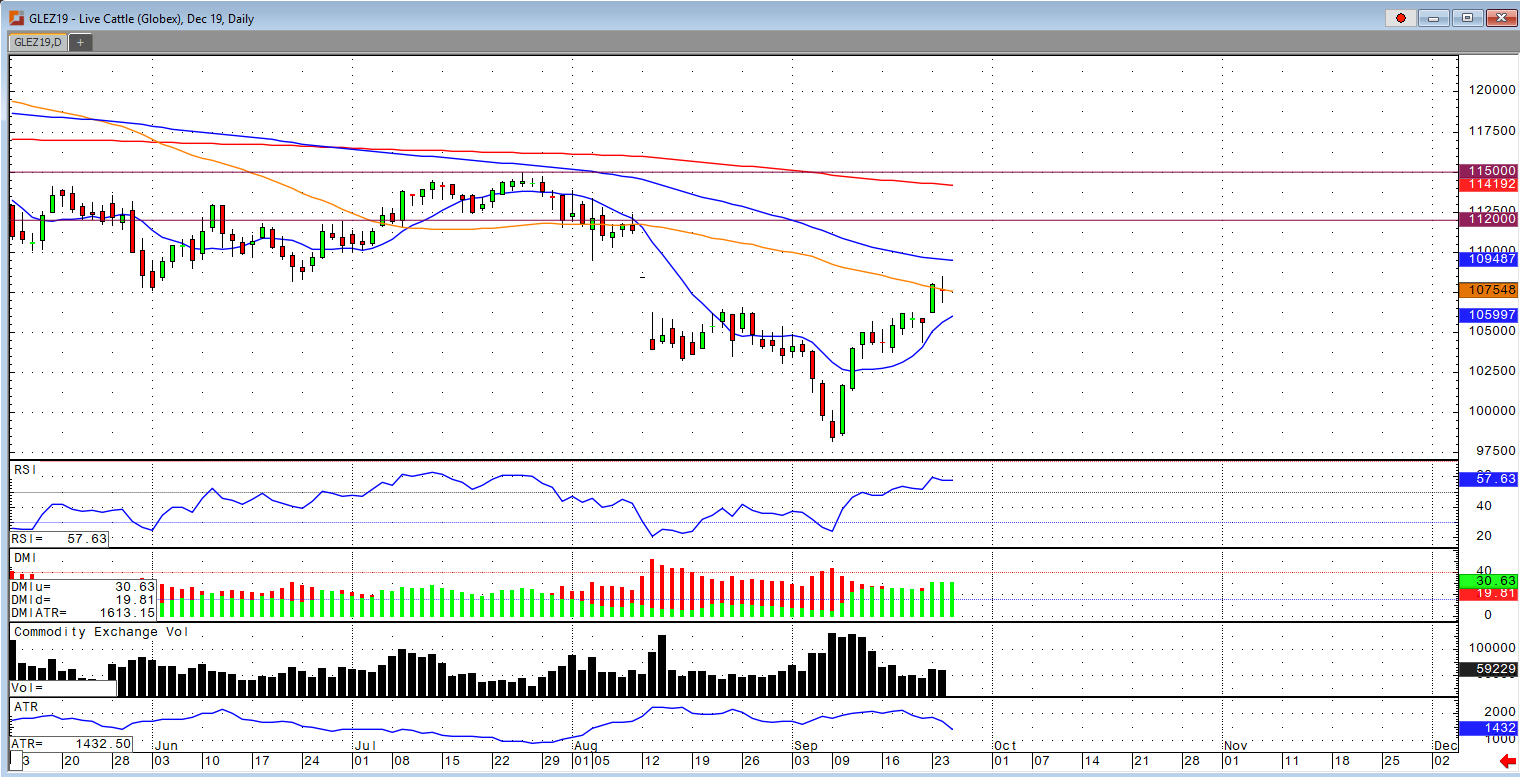

December cattle reached its highest level since August 9th before doing a hook reversal, another bearish chart pattern. The weakness in the beef market has also brought some cause for concern in terms of demand. USDA boxed beef cutout values were down 93 cents at mid-session yesterday and closed $1.06 lower at $215.39. This was down from $219.77 the prior week and is the lowest beef market since August 5th. The USDA estimated cattle slaughter came in at 117,000 head yesterday. This brings the total for the week so far to 233,000 head, down from 235,000 last week and down from 237,000 a year ago. The monthly cold storage report showed frozen beef stocks at the end of August at 469.38 million pounds, down 6.4% from last year but up 3.9% from July. Cold storage stocks normally show a slight increase for August, so the 3.9% increase is seen as bearish. We could see this market sell off for the rest of the week, but I still feel there is some good upside in the beef market, with little supply right now along with the technical gap in the market, I wouldn’t be surprised to see $112 to $115 December Cattle.