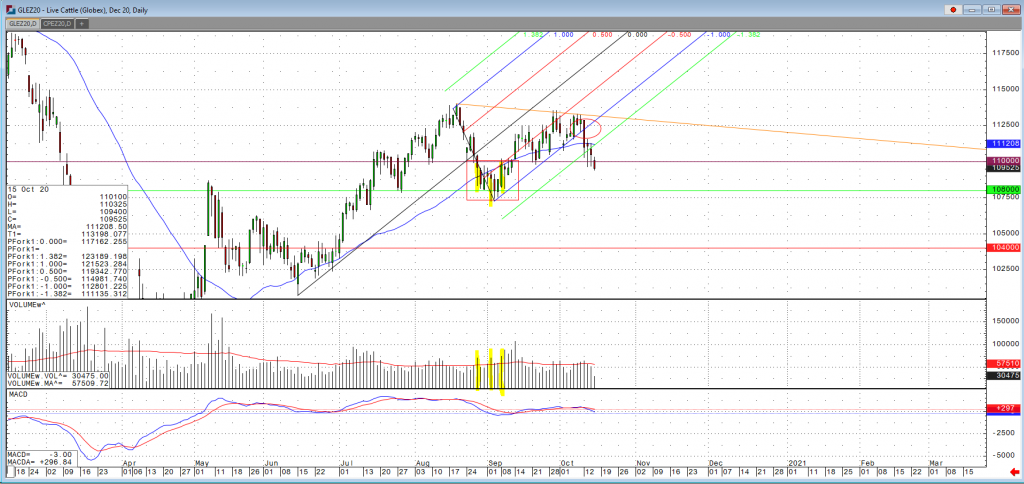

Dec cattle has closed lower today for the 5th time in the last 6 sessions, with the outlook of weaker seasonal demand and a cash market starting to trend lower cattle futures are now trending down back into price level we saw back in the beginning of September. Beef supply is still high with weights being at a 5 year high so even if we get a slight increase in slaughter numbers, that would put additional pressure on the market possibly bringing prices down to the early July levels of $106. With Dec cattle’s close under 109.65, the market has looked to violate $110 level and would look to continue to trend lower. In Nebraska 1,720 head traded at $107-$108 and an average price of $107.62 versus $108.16 last week. In Texas/Oklahoma 4,811 head traded at $108-$108.25 and an average price of $108.02 versus $108.90 last week. The USDA estimated cattle slaughter came in at 119,000 head yesterday. This brings the total for the week so far to 356,000 head, up from 355,000 last week and up from 351,000 a year ago. December cattle closed moderately lower on the session yesterday and the selling pushed the market down to the lowest level since September 11. Outside market forces are bearish with a negative tilt toward the economy as virus cases are on the rise in the US and around the world.